Valeant Investor Sequoia Fund to Limit Stakes in a Single Stock

May 20 2016 - 6:20PM

Dow Jones News

The leadership of a mutual fund hurt by an oversized position in

one stock—Valeant Pharmaceuticals International Inc.—on Friday

promised hundreds of investors gathered at the Plaza Hotel in New

York that it will cap the size of large stakes in the future.

In the meeting, the managers told shareholders they'd put in

place a new 20% limit on the percentage of the fund that can be

invested in a single security. The change was adopted by a recently

formed investment committee. The fund didn't previously have a

percentage limit.

Executives at Ruane, Cunniff & Goldfarb Inc.—which run the

Sequoia Fund that had invested in Valeant—took the stage at a hotel

ballroom around 10 a.m. and spent about 2½ hours on a presentation

to shareholders and fielding questions. More than a quarter of

those questions related to Valeant, people at the meeting said,

adding that some questions were tense.

"There were people who were angry with us and let us know how

hurt they felt, but in general the tone was respectful and

productive," said David Poppe, the lead manager of the fund.

Mr. Poppe became president of Sequoia after longtime manager

Robert Goldfarb resigned in March. "Hopefully people came away at

least feeling that we'd addressed their concerns directly," he

added.

Among the questions asked Friday was why Mr. Goldfarb wasn't at

the meeting. Mr. Poppe said he told the shareholder Mr. Goldfarb

had retired.

Sequoia's managers expected about 800 people to attend and the

crowd spilled over into a side room with a television monitor. The

firm said it selected the Plaza, at the base of Central Park over

its typical venue, the St. Regis Hotel, to accommodate a larger

crowd. Attendees had to be shareholders and present a ticket to

enter.

The value fund was hit hard by a heavy exposure to Valeant,

which at one point last year accounted for more than 30% of its

portfolio. Shares of Valeant have declined 73% this year amid

questions about its business and accounting practices.

The fund had about $5.1 billion in assets as of Thursday,

according to Morningstar Inc., and investors have pulled about $860

million out so far this year.

The Valeant position wasn't the first time a stock represented

more than 20% of Sequoia. In the early 2000s, Sequoia's investment

in Warren Buffett's Berkshire Hathaway Inc. represented more than

30% of its portfolio.

For investors, the two main questions were: How did the large

position in the troubled drugmaker get so big? And what will the

fund's managers do to avoid such troublesome stakes in the

future?

Michael Hyman, who invested in the fund several years ago

because his parents were shareholders, said he sold some of his

shares more than a year ago. At the time he was concerned over its

concentration in Valeant and the drug company's business model. He

said managers of the fund were "fairly direct" during the

meeting.

"I still have faith in Sequoia," he said.

(END) Dow Jones Newswires

May 20, 2016 18:05 ET (22:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

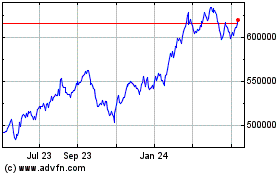

Berkshire Hathaway (NYSE:BRK.A)

Historical Stock Chart

From Mar 2024 to Apr 2024

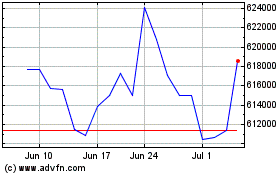

Berkshire Hathaway (NYSE:BRK.A)

Historical Stock Chart

From Apr 2023 to Apr 2024