Uninspiring Start to Q1 Earnings Season - Earnings Outlook

March 26 2014 - 4:01AM

Zacks

The following is an excerpt from this week's Earnings Trends

article. To see the full article, please click

here.

Uninspiring Start to Q1 Earnings Season

The first quarter comes to an end in a few days, but the 2014 Q1

earnings season has already gotten underway. By April 1st, we will

have seen results from almost 15 S&P 500 members (companies

with fiscal quarters ending in February get counted as part of the

Q1 tally).

Many of these early reporters aren’t obscure players as the list of

companies that have reported results already include industry

leaders like FedEx (FDX), Nike

(NKE), Oracle (ORCL), Walgreens

(WAG) and others. These initial reports don’t inspire much

confidence and appear to be pointing towards another underwhelming

reporting season ahead. But it’s perhaps premature to draw any firm

conclusions based on such an unrepresentative sample of

reports.

Expectations for the Q1 earnings season as whole remain low, with

total earnings expected to be down -1.8% from the same period last

year on +0.9% higher revenues and modestly lower margins.

As has been the trend for

more than a year now, estimates for Q1 came

down sharply as the quarter unfolded. The current -1.8% decline in

total earnings in Q1 is down from +2.1% growth expected at the

start of the quarter in January.

The -2.4% decline to total S&P 500 earnings since the start of

Q1 in January is greater than what we witnessed in the comparable

period in 2013 Q4, but is broadly in-line with the magnitude of the

4-quarter average of negative revision.

The chart below shows the magnitude of negative earnings revision

for 2014 Q1 and each of the preceding four quarters over the course

of each quarter.

Estimates for Q1 have fallen across the board, but the trend is

particularly notable for the Retail, Basic Materials, Autos,

Consumer Staples, and the Energy sectors, as the chart below

shows.

With two-thirds of S&P 500 members typically beating earnings

estimates in any reporting cycle, actual Q1 results will almost

certainly be better than these pre-season expectations. But Q1 is

unlikely to repeat the performance of the last few quarters when we

would witness new all-time records for total earnings each

quarter.

Guidance has been overwhelmingly weak for more than a year now,

keeping the revisions trend firmly in the negative direction. Odds

are that we wouldn’t see any change on that front this earnings

season either, bringing down estimates for the rest of the year.

Investors haven’t cared about negative estimate revisions thus far,

but it will be interesting that behavior will remain in place going

forward as well.

To see the full Earnings Trends report, please click

here.

ADOBE SYSTEMS (ADBE): Free Stock Analysis Report

FEDEX CORP (FDX): Free Stock Analysis Report

GENL MILLS (GIS): Free Stock Analysis Report

GOLDMAN SACHS (GS): Free Stock Analysis Report

JPMORGAN CHASE (JPM): Free Stock Analysis Report

ORACLE CORP (ORCL): Free Stock Analysis Report

WALGREEN CO (WAG): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

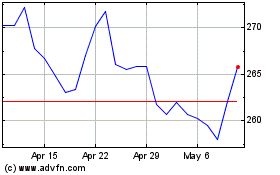

FedEx (NYSE:FDX)

Historical Stock Chart

From Mar 2024 to Apr 2024

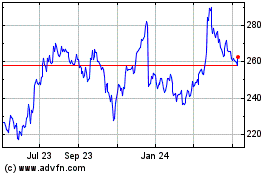

FedEx (NYSE:FDX)

Historical Stock Chart

From Apr 2023 to Apr 2024