UniCredit, Santander Terminate Asset Management Units Merger -- Update

July 27 2016 - 8:01AM

Dow Jones News

By Deborah Ball

MILAN-- UniCredit SpA said Wednesday that it has agreed with

Spain's Banco Santander SA to terminate an agreement struck last

year to merge its asset management units.

The Italian bank said that due to regulatory problems, it was

impossible to find a "workable solution within a reasonable time

horizon."

Last year, UniCredit and Santander reached a preliminary

agreement to merge its asset-management unit Pioneer with that of

the Spanish bank.

In Wednesday's statement, UniCredit said that it may now

consider an initial public offering of Pioneer.

The deal was meant to create a new group, boasting an enterprise

value of around EUR5.5 billion ($6 billion) and EUR400 billion in

assets under management. It was also meant to help UniCredit reduce

head count, a key goal in a bank that in the midst of a sweeping

cost-cutting campaign.

Jean Pierre Mustier, UniCredit's new chief executive, will

present a new strategic plan by year's end aimed at improving the

bank's profitability.

Santander Chief Executive José Antonio Álvarez said Wednesday

during an earnings presentation that the deal would have provided

scale to the lenders' asset managers and allowed them to offer a

wider range of products to clients. Now that the deal has fallen

through, he said, Santander will focus on improving its offering

for clients.

Write to Deborah Ball at deborah.ball@wsj.com

(END) Dow Jones Newswires

July 27, 2016 07:46 ET (11:46 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

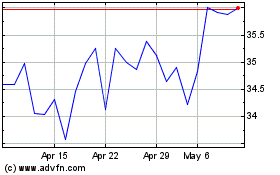

Unicredit (BIT:UCG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Unicredit (BIT:UCG)

Historical Stock Chart

From Apr 2023 to Apr 2024