UniCredit CEO Federico Ghizzoni Stepping Down -- Update

May 24 2016 - 3:46PM

Dow Jones News

By Deborah Ball

ROME -- The chief executive of UniCredit SpA, Italy's largest

bank, has agreed to step down, clearing the way for the board to

begin a search for his successor.

UniCredit said CEO Federico Ghizzoni will step down once a new

chief executive is found, to ensure a smooth transition.

The company's board "unanimously thanked Federico Ghizzoni for

the high quality of his work" under "extremely difficult market

conditions," a statement from the bank said Tuesday. UniCredit

didn't provide further details on the timing of the transition.

Speculation about the future of Mr. Ghizzoni, who became chief

executive in 2010, has been mounting for months, as investors

pummeled the bank's stock and major shareholders grew increasingly

convinced that new leadership was needed to restore confidence

According to people familiar with the situation, the board is

seeking an outsider who can spearhead a capital increase to

replenish the bank's capital cushion. Some said UniCredit needs to

raise as much as 9 billion euros ($10.1 billion) in fresh funds.

Those funds could come from a rights issue, asset sales, or both,

they said.

The bank's problems have been growing steadily in recent months.

It has struggled with low interest rates, given its large

concentration on traditional lending and its difficulty in

bolstering fee-earning businesses. It also has about EUR80 billion

in bad loans, more than any other bank in Europe.

Moreover, investors have grown increasingly concerned the bank's

capital cushion is too thin. UniCredit, which is the only

systemically important bank in Italy under new international

guidelines, has reported its core capital dropped during the first

quarter.

Mr. Ghizzoni came under particular criticism for the bank's

decision to underwrite the EUR1.5 billion capital increase of Banca

Popolare di Vicenza SpA. Earlier this spring, regulators grew

concerned investor sentiment toward Italian banking stocks was so

poor that the capital increase could fail, leaving UniCredit owning

the troubled bank. As a result, the government stepped in and

organized a fund supported by Italian financial institutions to

take over the transaction.

UniCredit's shares have lost more than 40% since the start of

the year. In recent days, it has risen on expectations of Mr.

Ghizzoni's resignation. In Tuesday's trading in Milan, the stock

rose 4.9%.

Write to Deborah Ball at deborah.ball@wsj.com

(END) Dow Jones Newswires

May 24, 2016 15:31 ET (19:31 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

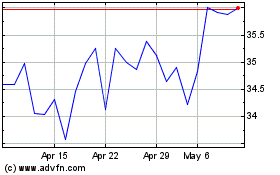

Unicredit (BIT:UCG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Unicredit (BIT:UCG)

Historical Stock Chart

From Apr 2023 to Apr 2024