Uganda Issues Oil Licenses to Total, Tullow; Expects $8 Billion Investment -- Update

August 30 2016 - 8:32AM

Dow Jones News

By Nicholas Bariyo

KAMPALA Uganda--The U.K.'s Tullow Oil PLC (TLW.LN) and France's

Total SA (TOT) have been issued eight oil production licenses in

Uganda, as the East African nation seeks to develop vast oil

reserves discovered a decade ago.

Tullow and Total are expected to invest $8 billion to develop

the oil fields, which will involve drilling more than 500 oil

wells, Irene Muloni, Uganda's energy and minerals minister, said

Tuesday.

"Time for waiting is now over" Ms. Muloni said, adding that "oil

companies are expected to make final investment decisions on these

projects within 18 months and first oil is expected by 2020."

The development ends nearly six years of talks with oil

companies. Uganda's oil assets are believed to contain some 6.5

billion barrels of crude.

Tullow will develop five oil fields, while Total with develop

three, all located along Uganda's western border with Congo.

Adewale Feyami, general manager of Total's Ugandan unit, said

that the company would dedicate financial and physical resources to

fast track the development of the project.

"We are committed to ensure that first oil from this project is

delivered as soon as possible," Mr. Feyami told reporters in

Kampala.

After falling to multi-year lows over the past two years, oil

prices have climbed more than 25% in 2016 on expectations that the

global glut of crude is set to shrink. But the price turmoil has

raised concerns among about frontier projects in Africa.

China's Cnooc Ltd., which jointly owns four oil blocks with

Total and Tullow in Uganda was the first to be issued with a

production license for the $2 billion Kingfisher oil field in 2013.

First oil from this field was initially expected to come on stream

in 2018, but this is now not expected until 2020.

The three companies are expected to start pumping as many as

230,000 barrels-a-day of crude for the issued licenses by 2020.

But according to Ahmed Salim, an analyst with Teneo

Intelligence, Uganda's latest target remains "ambitious" in light

of oil-price trends.

Total, Tullow and Cnooc said in a joint statement that the

approvals are a milestone for Uganda and the companies.

"It now paves way for the Joint Venture Partners to make

considerations for significant long-term capital and infrastructure

investments in Uganda," the companies said.

East Africa has been a focus for oil and gas exploration after a

flurry of discoveries in Uganda, Kenya and Tanzania in the past few

years. Analysts say the region could rival West Africa as the next

energy hub on the continent, given its close proximity to the

energy-hungry Asian markets.

Uganda's long-delayed decision comes weeks after Kenya approved

a plan to start oil production from oil fields in its remote north

western regions.

The development of Uganda's oil assets will include building a

1,443 kilometers (897 miles) crude export pipeline to the Tanzanian

port of Tanga. A 30,000 barrels-a-day refinery is also being

built.

According to Tullow, Uganda's oil development costs including

pipeline tariffs are estimated at $25 per barrel.

Write to Nicholas Bariyo at Nicholas.Bariyo@wsj.com

(END) Dow Jones Newswires

August 30, 2016 08:17 ET (12:17 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

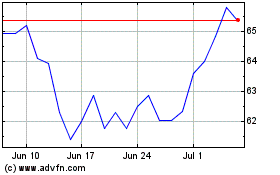

TotalEnergies (EU:TTE)

Historical Stock Chart

From Mar 2024 to Apr 2024

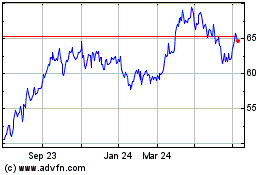

TotalEnergies (EU:TTE)

Historical Stock Chart

From Apr 2023 to Apr 2024