US Stocks Erase Last Week's Losses; S&P Ends With Nearly Four-Year High

March 26 2012 - 5:00PM

Dow Jones News

Stocks advanced after Federal Reserve Chairman Ben Bernanke

emphasized that low interest rates are still needed to support the

labor market, driving the S&P 500 to another nearly four-year

high.

Stocks opened higher on Monday and then padded gains throughout

trading session, wiping away all of last week's losses, which were

the steepest this year.

Before the opening bell, Bernanke said that continued

accommodative policies were needed to confront deep problems in the

jobs market. Some interpreted the statement to mean the door

remains open for another round of monetary stimulus from the

central bank.

"The Bernanke speech reiterated that the Fed may not do anything

now, but they aren't taking further policy options off the table,"

said Bill Stone, chief investment strategist at PNC Asset

Management Group.

The Dow Jones Industrial Average advanced 160.90 points, or

1.2%, to 13241.63. The Standard & Poor's 500-stock index rose

19.40 points, or 1.4%, to 1416.51 and ended the session with its

highest close since May 19, 2008. The Nasdaq Composite climbed

54.65 points, or 1.8%, to 3122.57, its highest finish in more than

a decade.

Health care stocks like Merck, up 1.7%, and Pfizer, up 1.6%,

spearheaded Monday's gains, followed closely by technology and

consumer discretionary stocks. All 10 of the S&P 500's sectors

gained ground. American Express rose 2.5%, J.P. Morgan Chase rose

2.2% and United Technologies rose 2.1%.

A pair of soft readings on the domestic economy did nothing to

hinder Monday's stock-market gains. Pending home sales fell

slightly in February versus expectations for a modest gain.

Separately, data showed business conditions in Texas-area

manufacturing are expanding this month but at a slower pace than in

February.

In Europe, the Stoxx Europe 600 closed up 0.9%, after Germany's

Ifo Institute said its business-confidence index for March slightly

exceeded expectations and rose to the highest reading in nine

months.

Concerns about whether Spain can implement austerity measures

eased after Germany officially backed down from its strict stance

against bolstering Europe's bailout funds.

The tone for today's gains was set by "better data out of

Germany, combined with plans for a larger firewall to help prevent

contain problems in the euro zone," Stone said.

In corporate news, Lions Gate Entertainment climbed 4.5% after

"The Hunger Games" grossed $155 million in North America over the

weekend, enough to be the third-largest opening weekend ever.

Cal-Maine Foods fell 6.1% after the egg producer reported fiscal

third-quarter earnings that topped estimates, though revenue fell

short of expectations, and gross margins declined with rising feed

costs.

Arena Pharmaceuticals surged 25% after the company said its

weight-loss drug candidate lorcaserin was accepted for review by

European regulators, and confirmed that a U.S. Food and Drug

Administration advisory committee will meet to discuss the

company's resubmitted application.

Safeway was the biggest decliner on the S&P 500, down 3.4%,

after Credit Suisse cut its stock-recommendation rating to

"neutral" from "outperform," citing concern that liabilities for

the grocery-store operator's pension plans may affect the stock's

valuation in the long term.

Buffalo Wild Wings jumped 7.3% as analysts at Stephens raised

the stock's price target, noting expectations for the sports bar

and grill to post strong first-quarter results.

-By Chris Dieterich, Dow Jones Newswires; 212-416-2611;

christopher.dieterich@dowjones.com

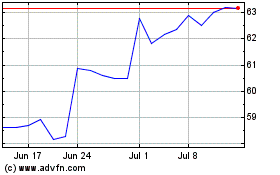

Cal Maine Foods (NASDAQ:CALM)

Historical Stock Chart

From Mar 2024 to Apr 2024

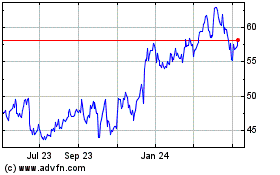

Cal Maine Foods (NASDAQ:CALM)

Historical Stock Chart

From Apr 2023 to Apr 2024