By Paul Ziobro

United Parcel Service Inc. wants to get paid for packages it

never delivers.

The company is starting to ask major retailers to help pay for

extra workers and surplus space on trucks when a retailer fails to

ship as many packages as planned during peak periods, UPS

executives say.

The new charges could also apply if a retailer's forecast veers

off course in other ways, such as if the sizes of boxes shipped are

significantly mismatched from what was expected.

"If there are variations to the plan, let's see what we can do,

but we should be compensated accordingly," said UPS Chief Executive

David Abney in an interview. He said the charge isn't meant to be

punitive but one element of a broader negotiation with retailers

over pricing during peak times.

UPS, like rival FedEx Corp., is grappling with the e-commerce

boom, which is resulting in more business but rising costs to pick

up, sort and deliver packages. The difficulties increase during the

peak holiday season, when a greater percentage of deliveries are to

homes and apartment buildings, which cost more for UPS to fulfill

than to business addresses.

Both companies are looking for ways to recoup the billions they

are investing to add capacity to their networks to handle the surge

in online shopping. FedEx says it has dropped some retailers that

refused recent price increases, and UPS has raised prices and

invested in new routing systems and bigger storage facilities.

It faces skepticism, however, that it isn't raising retailer

prices as aggressively as FedEx. Mr. Abney has previously said that

UPS could lose business if it doesn't make such changes carefully,

adding "You do that and at some point, you can have unused

capacity."

FedEx doesn't plan to charge retail customers that fall short on

promised package volumes, said its senior vice president for

e-commerce Carl Asmus. "The last thing I'd ever want to do or say

is I'm going to penalize a customer."

Like UPS, FedEx sets prices for large customers on a

case-by-case basis, with delivery rates varying based on the volume

of packages and where they need to be shipped, among other factors.

With its biggest retailer customers, the company starts the process

of planning for the holiday rush in June, Mr. Asmus said.

FedEx might adjust pricing lower for companies that ship larger

volumes but wouldn't charge them for failing to meet their

projections.

Delivery companies typically have multiyear contracts with top

retailers laying out rates, discounts and other elements about how

much it will cost to ship packages. But they still start up

conversations around midyear to share data and perform an autopsy

of the past holiday season and discuss how strategies and

investments should change for the next peak period.

Retailers, for their part, have their own challenges. Online

sales are coming at the expense of their brick-and-mortar

operations in many cases, forcing them to close stores and cut

costs wherever they can, and some of them lag behind newer players

when it comes to e-commerce.

Retailers with physical locations are increasingly using them as

places for customers to pick up online orders. Wal-Mart Stores

Inc., for example, last month began offering discounts to customers

who place orders for online-only merchandise and pick them up at

stores.

Those efforts could potentially lower some of the package volume

headed to residences if it is directed to stores instead -- "which

is great business for us," said Alan Gershenhorn, UPS's chief

commercial officer, during a conference call with analysts last

month.

UPS cautioned that conversations with retailers are just

starting and it is still working to complete how the surge price

will be implemented. "We will handle it on a customer by customer

basis, we will look at our costs and that's the way we're going to

address it," Mr. Abney said.

As it is for retailers, the peak season is a critical stretch

for UPS and FedEx. Last year, UPS said that daily delivery volume

on 13 days in December swelled to 30 million packages, compared

with 18 million on a normal nonpeak day.

Typically, the brunt of the surge comes from just a few dozen

e-commerce retailers. FedEx Chief Executive Fred Smith has said no

more that 50 customers are behind the bulk of the increase.

UPS is focusing the surcharge on the top shippers by volume

during the winter holidays. The company will also seek to apply it

to other events that cause volumes to swell, such as flower

shipments during Valentine's and Mother's Day, and when new

gadgets, videogames and books are released.

The extra business has posed a major challenge for the delivery

companies. Investors are worried that the capital investments to

keep up with the growth aren't paying off quickly enough,

especially during holidays.

"We believe that should be the company's highest margin quarter,

given the HR and logistics gymnastics UPS performs to execute for a

handful of e-commerce shippers," Stifel Nicolaus & Co. analyst

David Ross said in a research note.

One challenge has been that forecasting sales has become

increasingly challenging as shopping shifts online, oftentimes to

competitors such as Amazon.com Inc. Many traditional chains,

including Macy's Inc. and Toys "R" Us Inc., struggled to predict

their holiday sales last year.

"The problem for the shipper is that nobody is able to

accurately forecast e-commerce because things are changing so

rapidly," said John Haber, CEO of supply-chain consultancy Spend

Management Experts.

In 2015, UPS started imposing additional charges on shipments

when retailers blew through their shipping estimates, driving up

costs. But now, UPS is looking for protection on the downside

too.

FedEx ran into such trouble this past holiday season. In March,

the company said some of its largest retail customers that use its

ground-shipping business fell short of their forecasts. That left

FedEx confronting a burden from spending the company put toward

extra staffing and trucks. Operating margins for FedEx's ground

segment declined from 12.6% to 11% in the quarter ended Feb.

28.

During March's earnings call, FedEx Chief Marketing Officer

Rajesh Subramaniam said the company is "looking at several pricing

options to ensure that we get a reasonable return on investments

that we are making."

--Brian Baskin contributed to this article.

Write to Paul Ziobro at Paul.Ziobro@wsj.com

(END) Dow Jones Newswires

May 01, 2017 16:55 ET (20:55 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

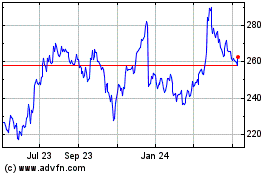

FedEx (NYSE:FDX)

Historical Stock Chart

From Mar 2024 to Apr 2024

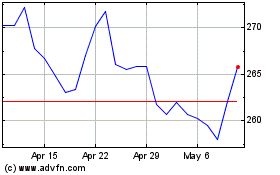

FedEx (NYSE:FDX)

Historical Stock Chart

From Apr 2023 to Apr 2024