UPS Profits Rise on E-Commerce Growth -- Update

July 29 2016 - 2:09PM

Dow Jones News

By Laura Stevens

United Parcel Service Inc. on Friday reported a 3.2% increase in

profit fueled in part by e-commerce growth, but the delivery giant

cautioned that a weaker industrial environment will continue to be

a drag.

Revenue increased 3.8% to $14.63 billion for the second quarter,

while profit rose to $1.27 billion. UPS forecast its e-commerce

business will grow faster than expected through the end of the

year, as U.S. consumers continue to show strength.

"In our domestic side, we've expanded our margins even though

the economy isn't as good as we would like for it to be," Chief

Executive David Abney said in an interview. "But we have realized

that the key to us is not what the economy may hand to us or may

blow against us, but it's a lot more about staying focused on our

strategies."

The results show that the company's efforts to improve

profitability in the higher-cost e-commerce delivery segment are

starting to pay off. But the strength in e-commerce and consumer

spending was countered by slowing exports due to the greenback's

strength and an inventory overhang among industrial customers,

which is hurting business-to-business shipments, UPS' traditional

stronghold.

Delivering e-commerce packages tend to be more expensive due to

the scattered nature of the residential deliveries and UPS has

undertaken several initiatives to produce better returns. It has

raised prices across the board, with specific increases targeted at

bigger and bulkier packages that fill up trucks and take more time

to deliver. The company also has been working to pool more consumer

deliveries, adding retail locations and lockers for pickups.

Its proprietary-routing software, Orion, has helped it to shave

minutes and miles off drivers' routes. Second-quarter delivery

stops grew by more than 3%, but the company reduced its miles

driven by a fraction of a percent and kept the cost per piece down.

UPS plans to expand the roll out of the technology so that it is

ready for the all-important holiday season.

Operating profits in the company's U.S. business increased 2.7%

to $1.23 billion.

Mr. Abney deflected a question from an analyst on the threat of

Amazon.com Inc. in taking on more of its own logistics operations

and deliveries. He said UPS' large customer base means it will

always have more deliveries to more addresses, which in turn allows

it to have lower prices and better reliability.

Cross-border and export shipment growth in Europe helped fuel

the company's international results. Shipments from Europe to the

U.S. alone grew at a double-digit pace in the quarter. Operating

profit at its international division grew 11.1% to $613 million on

nearly flat revenues. UPS has been expanding in Europe and other

international markets, and executives said that they would be

keeping an eye out for potential acquisitions in emerging

markets.

The company maintained its earnings guidance for the year but

cautioned that the third quarter would face difficult comparisons

due in part to one less operating day.

Write to Laura Stevens at laura.stevens@wsj.com

(END) Dow Jones Newswires

July 29, 2016 13:54 ET (17:54 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

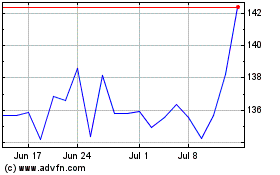

United Parcel Service (NYSE:UPS)

Historical Stock Chart

From Mar 2024 to Apr 2024

United Parcel Service (NYSE:UPS)

Historical Stock Chart

From Apr 2023 to Apr 2024