UPS Profit Tops Views on Growth in International Segment

February 02 2016 - 8:57AM

Dow Jones News

By Anne Steele

United Parcel Service Inc. on Tuesday reported

better-than-expected earnings in the most recent quarter as growth

in international package delivery drove profitability.

Shares of UPS, down 10% over the past three months, rose 3.1% to

$97 in premarket trading as the company also offered upbeat

earnings guidance for the current year.

Chief Financial Officer Richard Peretz said this was the fourth

consecutive quarter UPS exceeded financial expectations.

"While we face uncertain macroeconomic conditions, we are

continuing to invest for profitable growth," he said.

For 2016, UPS expects earnings of $5.70 to $5.90 a share, a 5%

to 9% increase over adjusted 2015 results. Analysts were expecting

$5.73 a share, according to Thomson Reuters.

For the quarter ended Dec. 31, UPS posted earnings of $1.33

billion, or $1.48 a share, up from $453 million, or 49 cents a

share, a year earlier. Adjusted earnings were $1.57 a share.

Fourth-quarter 2015 results included a pension charge of $79

million to recognize lower-than-planned asset returns that were

somewhat offset by a higher discount rate. In the period last year,

the company reported charges of $692 million related to pension and

the transfer of certain health-care liabilities.

Revenue edged up 1% to $16.05 billion. Excluding currency

impacts, revenue would have risen 2.4%.

Analysts had expected earnings of $1.42 a share on revenue of

$16.28 billion.

Total company shipments grew 1.8% to 1.3 billion packages, led

by U.S. air products and European transborder shipments.

In the domestic segment, profit rose an adjusted 18%. Daily

shipments ticked up 2.4%, helped by strong demand from e-commerce

shippers.

Profit in the international segment grew 16% to $624 million,

helped by disciplined pricing, favorable customer and product mix,

and improved operational performance.

In the supply chain and freight segment, operating profit

increased 11% to $199 million. The company's acquisition of Coyote

Logistics, which closed during the previous quarter, more than

offset the impact of softer markets, lower fuel surcharges and

actions to improve revenue quality in the other business units.

Write to Anne Steele at Anne.Steele@wsj.com

(END) Dow Jones Newswires

February 02, 2016 08:42 ET (13:42 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

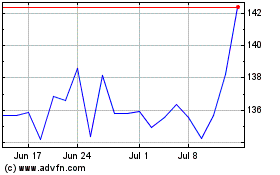

United Parcel Service (NYSE:UPS)

Historical Stock Chart

From Mar 2024 to Apr 2024

United Parcel Service (NYSE:UPS)

Historical Stock Chart

From Apr 2023 to Apr 2024