UBS Sets Up Frankfurt Headquarters for European Wealth Management Operation

December 01 2016 - 11:30AM

Dow Jones News

ZURICH—Frankfurt, a financial center vying with other European

cities to become a potential alternative to London for global

investment banks following the U.K. vote to leave the European

Union, has received a shot in the arm from Swiss banking giant UBS

Group AG.

Zurich-based UBS said Thursday that it has established a

long-anticipated entity in Frankfurt to centralize European

operations. Most of UBS's wealth management businesses in Europe

have been combined into the subsidiary, dubbed UBS Europe SE.

UBS had considered London and Luxembourg for the new European

entity since beginning planning a few years ago. A UBS spokesman

said the decision for Frankfurt isn't related to the U.K.'s vote

earlier this year to leave the EU. The Brexit vote has called into

question whether global banks will retain large operations in

London.

UBS and others maintain significant investment bank operations

in London, but may now need to find an alternative location for the

so-called passporting of services into EU countries. Frankfurt and

other European cities aiming to lure financial services firms may

benefit as a result.

UBS's establishment of its Frankfurt subsidiary, which is

regulated by Germany's BaFin, enables the bank to free up capital

held protectively in various other European countries in response

to local regulators' demands.

UBS will continue to be present in European countries like the

Netherlands and Spain through branches.

Write to John Letzing at john.letzing@wsj.com

(END) Dow Jones Newswires

December 01, 2016 11:15 ET (16:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

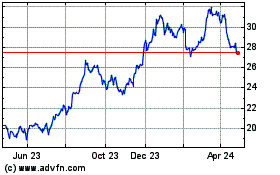

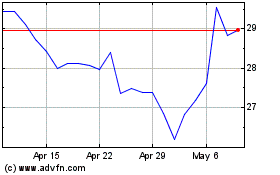

UBS (NYSE:UBS)

Historical Stock Chart

From Mar 2024 to Apr 2024

UBS (NYSE:UBS)

Historical Stock Chart

From Apr 2023 to Apr 2024