For the first time in 10 years, average wealth of self-made

US billionaires surpasses average wealth of US billionaires with

inherited fortunes

Key findings:

- Total billionaire wealth declined in 2015 by $300 billion to

$5.1 trillion while average billionaire wealth fell from $4.0

billion to $3.7 billion due to headwinds such as the transfer of

assets within families, commodity price deflation and an

appreciating US dollar

- Europe has the greatest number of multigenerational

billionaires at 182 (54%), and they have proven to be the most

resilient at preserving their fortunes. The US has 175 (33%)

multi-generational billionaires and APAC has 76 (15%)

- For the first time in 10 years, the average wealth of self-made

US billionaires surpassed the average wealth of US billionaires

with inherited fortunes ($4.5 billion vs $4.3 billion)

- Approximately 460 billionaires will transfer $2.1 trillion to

their heirs in the next 20 years

- Led by China, Asia created one billionaire nearly every three

days accounting for over half of new billionaires in 2015

UBS Group AG and PwC today presented their joint annual

billionaires report, “Are billionaires feeling the pressure?” The

report examines wealth creation within the billionaire segment in

2015 and singles out the transfer of $2.1 trillion in billionaire

wealth that is expected over the next two decades.

2015 saw a pause as total billionaire wealth fell by $300

billion to $5.1 trillion. Headwinds such as the transfer of assets

within families, commodity price deflation and an appreciating US

dollar, have impacted the growth of billionaire wealth. Average

billionaire wealth dropped from $4.0 billion to $3.7 billion and

the US added only five net new billionaires in 2015. In contrast,

Asia produced one billionaire every three days, with China alone

accounting for over half of the 113 additions.

The findings build on UBS/PwC's previous billionaire reports,

released in May and December 2015. According to the new report, we

are about to witness the greatest transfer of wealth in history.

Approximately 460 billionaires will transfer $2.1 trillion, the

equivalent of India’s GDP, to their heirs over a period of just 20

years. For most of Asia’s young economies, where over 85% of

billionaires are first-generation, this will be the first-ever

handover of billionaire wealth.

John Mathews, Head of Ultra High Net Worth, UBS Wealth

Management Americas, comments on the new report:

"The U.S. has always been a standout for creating wealth, and

this report shows that the American dream is alive, with the wealth

of the self-made billionaires outweighing that of the

multi-generational billionaire.

"As we head into the greatest period of wealth transfer we’ve

ever seen, there is much insight that we can gain from the

experience of the successful wealth transfer and legacy planning

that takes place in Europe.

"The findings of this report help UBS stay ahead of the issues

that matter in order to better advise our clients, which include

over half the world’s billionaires."

Michael Spellacy, Global Wealth Leader at PwC US:

“As the shockwaves from regulatory upheaval in the EU continue

to trigger global currency fluctuations, strategic planning becomes

even more crucial for wealth preservation. Those who control assets

face tough investment questions.

“Encouragingly, this year's report shows that Europe's

billionaires were the most resilient with many of the 60

individuals from Europe inheriting their fortunes in 2015 for the

first time.

“The US, which boasts the biggest collection of billionaires by

region, sets the trend. Total US billionaire wealth fell, but 'new

money' fared better than old, falling by just 4%, from an average

of $4.7 billion per individual to $4.5 billion.”

Key findings from the report include:

A $2.1 trillion

inheritance

The past 20 years of exceptional wealth creation will soon be

followed by the largest-ever wealth transfer. We estimate that less

than 500 people (460 of the billionaires in the markets we cover)

will hand over $2.1 trillion, a figure equivalent to India’s GDP,

to their heirs in the next 20 years. For most of Asia’s young

economies, where over 85% of billionaires are first generation,

this will be the first-ever handover of billionaire wealth.

The Gilded Age pauses

After more than 20 years of unprecedented wealth creation, the

Second Gilded Age has stalled. The transfer of assets within

families, commodity price deflation and an appreciating US dollar

have emerged as significant headwinds. In 2015, in the markets we

cover, 210 fortunes broke through the billion-dollar wealth ceiling

and 160 billionaires dropped off, leading to a net increase in the

billionaire population of 50 to 1,397. Yet their total wealth fell

from $5.4 trillion to $5.1 trillion. Average wealth fell from $4

billion in 2014 to $3.7 billion in 2015. It is still too early to

tell if 2015 signals a pause in the Gilded Age or something

more.

Old legacies’ lessons for new

billionaires

Of the billionaire fortunes that have fallen below the

billion-dollar mark since 1995, 90% were not preserved beyond the

first and second generations. At a time of economic headwinds and

imminent wealth transfer, Europe’s old legacies are a model for new

billionaires to avoid this fate. Germany and Switzerland, in

particular, are the countries with the greatest share of ‘old’

wealth. Asia’s family-orientated billionaires may wish to adapt the

European model of wealth preservation to their own needs.

New philanthropic models

In the first half of the 20th century, entrepreneurial families

such as the Carnegies and Rockefellers funded significant advances

in areas such as education and health. By doing so, they displayed

many traits associated with billionaires – chiefly business focused

and smart risk-taking – to drive success. After over three decades

of this new Gilded Age, billionaire philanthropy is growing all

over the world. New philanthropic models are emerging (loans,

guarantees, contracts, impact investing etc.) and the millennial

generation is putting philanthropy at the heart of their family

values. In spite of this the current Gilded Age may not match its

predecessor’s record.

To find out more, we invite you to read the full report here:

www.ubs.com/billionaires

Methodology

This year, the report has analyzed data covering 1,397

billionaires and looking back two decades. The database includes

the 14 markets, which belong to the largest markets in the US,

Europe and APAC and account for around 80% of global billionaire

wealth. Furthermore, we conducted over 20 interviews with

billionaire advisors, as well as face-to-face interviews with more

than 30 billionaires and approximately 30 of their heirs. UBS and

PwC advise a large number of the world’s wealthy, and have unique

insights into their changing fortunes and needs.

A number of sources were utilized to research and profile the

characteristics of wealthy individuals. These were blended into a

mosaic analytical framework from which we conducted extensive

modelling and analysis. This information and data is part of PwC

proprietary data and analytics structures, non-commercial in nature

and specifically non-attributable regarding the identity of any

individual or family.

PwC acts as a supplier of data and analysis for the purpose of

this report. In addition, the following sources were specifically

used as a part of our research:

- PwC has a significant body of research

drawn from publishing studies on Wealth and Private Banking, and

Family Businesses including current and future perspectives on a

number of industries from which we were able to derive insights.

These include but are not limited to Next Generation Survey of

Family Business Leaders 2016; Banking Tax 2020; 18th Annual Global

CEO Survey: A Private Company View (2015); Family Business Survey:

Up Close and Professional (2014); and from our network firm INTES:

Nachfolge in Familienunternehmen (2015). Further, UBS’s body of

research and insights in wealth and private banking were leveraged.

These include, but are not limited to, the UBS House View: Year

Ahead 2016: The answers for 2016 and Years Ahead: our 5-7 year

view; UBS Investor Watch: The Global Family Office Report 2015; UBS

Philanthropy Compass; UBS-INSEAD study: Family Philanthropy in Asia

and UBS; Harvard Study: From Prosperity to Purpose.

- Other analysis is based on our

proprietary PwC databases which cover detailed non-client-specific

bottom-up data on approximately 1,400 billionaires from the US,

Germany, UK, France, Switzerland, Turkey, Italy, Spain, China,

India, Hong Kong, Japan, Singapore and Russia. This is a private

non-commercial data structure designed to support analysis of

specific market segments.

- Specific interviews with a number of

billionaires and representatives of the next generation in various

geographies were conducted by PwC and UBS separately and the

information from those qualitative discussions was incorporated on

a non-attributable basis without regard to any business /client

relationship with any person, firm or organization. Further, we

have conducted over 20 interviews with billionaire advisors.

- For the long-term series of the MSCI

and GDP data we used the MSCI World gross data (accessed on

05/2016) and the World Bank’s Global Economic Prospect database

respectively (accessed on 05/2016).

Notes to Editors

About the UBS-PwC Billionaires Report

This report is unique in its scope and approach. It addresses

the characteristics and challenges facing some of the wealthiest

individuals in the world. It paints a portrait of how they achieve

great wealth, and the challenge around passing it on and what will

be the nature of their legacy. It is global in scope across all

major markets and covers both self-made and inherited wealth.

Different regions, cultures and backgrounds have different

distinctive drivers of wealth. Many of the lessons gleaned from

this work are broadly applicable to anyone with wealth and a

perspective on it, their plans for the future and their families

and what will be their lasting legacies.

About UBS

UBS provides financial advice and solutions to wealthy,

institutional and corporate clients worldwide, as well as private

clients in Switzerland. The operational structure of the Group is

comprised of our Corporate Center and five business divisions:

Wealth Management, Wealth Management Americas, Personal &

Corporate Banking, Asset Management and the Investment Bank. UBS's

strategy builds on the strengths of all of its businesses and

focuses its efforts on areas in which it excels, while seeking to

capitalize on the compelling growth prospects in the businesses and

regions in which it operates, in order to generate attractive and

sustainable returns for its shareholders. All of its businesses are

capital-efficient and benefit from a strong competitive position in

their targeted markets.

UBS is present in all major financial centers worldwide. It has

offices in 54 countries, with about 34% of its employees working in

the Americas, 35% in Switzerland, 18% in the rest of Europe, the

Middle East and Africa and 13% in Asia Pacific. UBS Group AG

employs approximately 60,000 people around the world. Its shares

are listed on the SIX Swiss Exchange and the New York Stock

Exchange (NYSE).

About PwC

At PwC, our purpose is to build trust in society and solve

important problems. We’re a network of firms in 157 countries with

more than 208,000 people who are committed to delivering quality in

assurance, advisory and tax services. Find out more and tell us

what matters to you by visiting us at www.pwc.com.

PwC refers to the PwC network and/or one or more of its member

firms, each of which is a separate legal entity. Please see

www.pwc.com/structure for further details.

About the UBS-PwC Billionaires Report

This report is unique in its scope and approach. It addresses

the characteristics and challenges facing some of the wealthiest

individuals in the world. It paints a portrait of how they achieve

great wealth, and the challenge around passing it on and what will

be the nature of their legacy. It is global in scope across all

major markets and covers both self-made and inherited wealth.

Different regions, cultures and backgrounds have different

distinctive drivers of wealth. Many of the lessons gleaned from

this work are broadly applicable to anyone with wealth and a

perspective on it, their plans for the future and their families

and what will be their lasting legacies.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20161013005094/en/

MediaUBSErica Chase,

+1-212-713-1302erica.chase@ubs.com

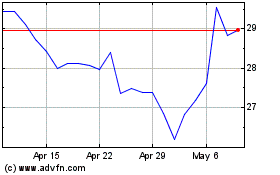

UBS (NYSE:UBS)

Historical Stock Chart

From Mar 2024 to Apr 2024

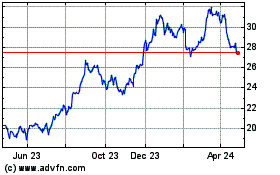

UBS (NYSE:UBS)

Historical Stock Chart

From Apr 2023 to Apr 2024