U.S. Stock Futures Inch Lower

August 17 2015 - 9:10AM

Dow Jones News

U.S. stock futures slipped on Monday, signaling a modestly lower

open, as shares looked set to give back some of last week's

gains.

Futures on the S&P 500 index fell three points, or 0.1%, to

2087. E-mini Dow futures contracts were down 0.2%, while the e-mini

contract on the Nasdaq 100 lost 0.1%.

Monday marks the latest sideways move for stocks, which have

stuck to a narrow range this summer as investors grapple with

lackluster second-quarter earnings, upheaval in Chinese markets and

turmoil over Greek finances. The S&P 500 index is down 0.6%

through Friday in August.

"The end of August I think will be quiet now that these China

things have kind of settled down," said Michael Antonelli, equity

sales trader at Robert W. Baird. "We're still stuck in the middle

of this range."

The coming week will be relatively light on both economic data

and corporate earnings. Monday brings a report on August

manufacturing activity in New York, as well as data on the housing

market from the National Association of Home Builders.

With the bulk of second-quarter earnings reports in the rearview

mirror, companies in the S&P 500 are on track to report a

quarterly decline in profits of 0.8%, according to FactSet, with

465 companies reporting.

Shares of Esté e Lauder Cos. fell 2.2% in premarket trading

after the makeup and fragrance company reported a fiscal

fourth-quarter profit that beat expectations but gave a downbeat

outlook.

Tesla Motors Inc. shares added 6% premarket after analysts at

Morgan Stanley sharply raised their price target on the stock to

$465 from $280. Shares closed at $243.15 on Friday.

In Europe, stock markets were mixed. The Stoxx Europe 600 index

was nearly flat, while Germany's DAX fell 0.3%. France's CAC 40

index gained 0.1%.

Investors in Europe also drew comfort from progress on a new

bailout for Greece, after €86 billion (around $96 billion) in loans

to Athens were cleared by the eurozone on Friday after markets

closed. The main Athens stock index was 0.6% higher.

Chinese stock markets were higher, with the Shanghai Composite

gaining 0.7% as government funds continued to stabilize the market.

Hong Kong's Hang Seng fell 0.7%. China eased fears that its

currency is headed for a protracted decline by setting the yuan on

Monday near Friday's close.

In commodities markets, oil futures fell 1.6% to $41.83 a

barrel. Gold added 0.3% to $1115.90 per ounce.

The yield on the U.S. 10-year Treasury eased slightly to 2.185%

as prices rose.

Write to Dan Strumpf at daniel.strumpf@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

August 17, 2015 08:55 ET (12:55 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

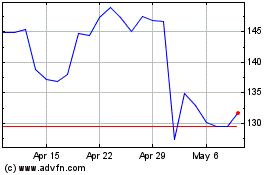

Estee Lauder Companies (NYSE:EL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Estee Lauder Companies (NYSE:EL)

Historical Stock Chart

From Apr 2023 to Apr 2024