U.S. Retail Sales Rose 0.6% in September

October 14 2016 - 9:10AM

Dow Jones News

WASHINGTON--U.S. retail sales rose at a solid pace in September,

rebounding after a modest pullback the prior month and signaling

that consumers are set to support stronger economic growth during

the second half of the year.

Sales at retail stores, online retailers and restaurants

increased 0.6% from the prior month to a seasonally adjusted

$459.82 billion in September, the Commerce Department said Friday.

Sales had declined 0.2% in August, revised up from an initially

estimated 0.3% decline, and rose 0.1% in July.

Economists surveyed by The Wall Street Journal had expected a

0.6% increase from August.

The headline figure was boosted by spending on motor vehicles

and gasoline. Excluding the automotive category, retail sales rose

0.5% in September; economists had expected a 0.4% rise. Excluding

both automotive and gasoline purchases, September sales were up

0.3% from August.

Compared with a year earlier, total retail sales in September

were up 2.7%, outpacing the modest rise in consumer prices over the

past year. The retail-sales data were not adjusted for

inflation.

Sales in the third quarter were up 0.7% from the strong second

quarter and rose 2.4% compared with the third quarter of 2015.

Total sales in the first nine months of the year were up 2.9% from

the same period in 2015.

Consumer spending accounts for more than two-thirds of U.S.

economic activity as measured by gross domestic product. Supported

by gradually rising wages as the labor market tightens, a surge in

household outlays during the second quarter helped

inflation-adjusted GDP grow at a modest 1.4% annual pace despite

weakness in other areas including inventories, residential

construction and government expenditures.

Economists have predicted a pickup in GDP growth during the

recently ended third quarter, aided by healthy consumer spending.

Despite August's weak retail sales, gauges of consumer sentiment

have remained buoyant in recent months.

"Household spending has been the main contributor to real GDP

growth over the past four quarters, and, with solid gains in

employment and household income and upbeat consumer sentiment, this

sector should continue to support growth over the second half of

the year," Federal Reserve Vice Chairman Stanley Fischer said last

weekend.

Forecasting firm Macroeconomic Advisers, as of last week,

predicted GDP growth at a 2.8% annual rate in the third quarter.

The Atlanta Fed's GDPNow model was somewhat less optimistic,

pegging the third-quarter growth rate at 2.1%. The Commerce

Department will release its first official estimate for

third-quarter GDP on Oct. 28.

One headwind for the economy in recent months has been

uncertainty stemming from the heated U.S. election campaign, which

could prompt some businesses and consumers to delay major spending

or other financial decisions.

"There is just great uncertainty as to what's going to happen in

the U.S., in particular, as a result of the outcome of the

election," Yum Brands Inc. Chief Executive Greg Creed told analysts

last week, adding, "I think people are maybe just hunkering down a

little bit."

Most categories in Friday's report saw sales rise last month,

including a 0.8% increase in spending at restaurants and bars--the

largest one-month jump for the category since February.

American consumers last month continued to shift their spending

to e-commerce platforms like Amazon.com from traditional

brick-and-mortar retailers. Sales in the nonstore category,

including online retailers, were up 11.0% in the first nine months

of 2016 compared with a year earlier. Sales at department stores

were down 4.8% over the same period.

Motor vehicle and auto-parts sales in September were up 1.1%

from the prior month, according to Friday's report. Automakers had

earlier reported U.S. unit sales of cars and light trucks in

September were up from August but down from one year earlier.

Gasoline-station sales jumped 2.4% last month, potentially

reflecting rising prices at the pump. The average price for a

gallon of regular gasoline in September was $2.16, up four cents

from August, according to the U.S. Energy Information

Administration.

Sales at electronics and appliance stores fell 0.9% in September

despite the release of Apple Inc.'s new iPhone 7. The release of

new iPhone models in September 2015 had coincided with the only

monthly sales increase for the electronics category during the

second half of last year, according to Commerce Department

data.

Write to Ben Leubsdorf at ben.leubsdorf@wsj.com and Eric Morath

at eric.morath@wsj.com

(END) Dow Jones Newswires

October 14, 2016 08:55 ET (12:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

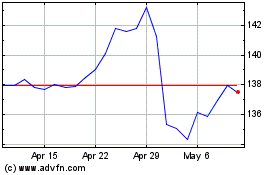

Yum Brands (NYSE:YUM)

Historical Stock Chart

From Mar 2024 to Apr 2024

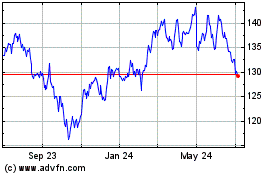

Yum Brands (NYSE:YUM)

Historical Stock Chart

From Apr 2023 to Apr 2024