U.S. Housing Starts Pull Back 6.8% In March, More Than Expected

April 18 2017 - 5:06AM

RTTF2

New residential construction in the U.S. pulled back sharply in

the month of March, according to a report released by the Commerce

Department on Tuesday, although the report also showed a rebound in

building permits.

The report said housing starts plunged by 6.8 percent to an

annual rate of 1.215 million in March from an upwardly revised

1.303 million in February.

Economists had expected housing starts to drop by 2 percent to a

rate of 1.262 million from the 1.288 million originally reported

for the previous month.

The bigger than expected decrease in housing starts reflected

notable declines in both single-family and multi-family starts.

Single-family starts tumbled by 6.2 percent to a rate of

821,000, while multi-family starts slumped by 7.9 percent to a rate

of 394,000.

The report also showed steep drops in housing starts in the

Midwest and West, where starts plummeted by 16.2 percent and 16.0

percent, respectively.

Housing starts in the South also fell by 2.9 percent, although

housing starts in the Northeast surged up by 12.9 percent.

Meanwhile, the Commerce Department said building permits, an

indicator of future housing demand, jumped by 3.6 percent to a rate

of 1.260 million in March from a revised 1.216 million in

February.

Building permits had been expected to climb by 3.1 percent to a

rate of 1.250 million from the 1.213 million that had been reported

for the previous month.

Multi-family permits led the way back to the upside, jumping by

13.8 percent to a rate of 437,000 in March after plummeting by 21

percent to a rate of 384,000 in February.

On the other hand, the report said single-family permits slid by

1.1 percent to a rate of 823,000 in March from a rate of 832,000 in

February.

Building permits in the West, Northeast, and South saw notable

increases during the month, while building permits in the Midwest

fell sharply.

On Monday, the National Association of Home Builders released a

report showing a bigger than expected pullback in homebuilder

confidence in the month of April.

The report said the NAHB/Wells Fargo Housing Market Index

dropped to 68 in April after jumping to 71 in March. Economists had

expected the index to edge down to 70.

The bigger than expected decrease by the index came after it

reached its highest level since June of 2005 in the previous

month.

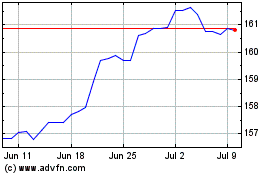

US Dollar vs Yen (FX:USDJPY)

Forex Chart

From Mar 2024 to Apr 2024

US Dollar vs Yen (FX:USDJPY)

Forex Chart

From Apr 2023 to Apr 2024