U.S. Hot Stocks: Hot Stocks to Watch

September 02 2016 - 9:42AM

Dow Jones News

Among the companies with shares expected to trade actively in

Friday's session are Merck & Co. (MRK), Ambarella Inc.(AMBA)

and Broadcom Ltd. (AVGO).

Merck & Co. said it would discontinue developing the

osteoporosis drug odanacatib and not seek regulatory approval for

the treatment because of the higher risk of stroke. Shares fell

0.6% to $62.52 in premarket trading.

Alcoa Inc. (AA) and joint-venture partner Alumina Ltd. (AWCMY)

have settled their dispute, ending competing litigation and

removing a potential hurdle to Alcoa's plans to split into two new

companies later this year.

Ambarella Inc., a key chip supplier to struggling GoPro Inc.,

saw shares slip after hours on Thursday with sales and profit

posting a quarterly fall though results were better than expected.

Shares fell 1.48% to $70.72 premarket.

Broadcom Ltd. swung to a loss in the latest quarter, but its

adjusted earnings -- which excludes acquisition and

restructuring-related expenses, among other items -- beat

expectations. Shares fell 0.33% to $176.50 premarket.

Contact-lens company Cooper Cos. (COO) on Thursday raised its

financial projections following better-than-projected third-quarter

results. Separately, the company said Chief Financial Officer

Gregory W. Matz, who also serves as the company's chief risk

officer, plans to retire on Oct. 31, the end of Cooper's business

year. He will stay on in an advisory role through March.

Dean Foods Co. (DF) on Thursday named Ralph Scozzafava as the

company's new chief executive, taking over for Gregg Tanner on Jan.

1.

Gap Inc. (GPS) said same-store sales, a key industry metric,

fell 3% in August, evidence that the struggling retailer still has

work to do.

Lululemon Athletica Inc. (LULU) on Thursday raised its financial

projections for the year, but sales in the most recent quarter were

slightly weaker-than-expected.

Smith & Wesson Holding Corp.'s (SWHC) sales jumped 40% and

profit more than doubled in its first quarter, leading the firearms

maker to sharply raise financial projections for the year.

VeriFone Systems Inc. (PAY) issued a disappointing outlook for

the current quarter Thursday as the payments-technology company's

revenue missed expectations for the three months ended July,

sending shares lower.

Write to Chris Wack at chris.wack@wsj.com or Maria Armental at

maria.armental@wsj.com

(END) Dow Jones Newswires

September 02, 2016 09:27 ET (13:27 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

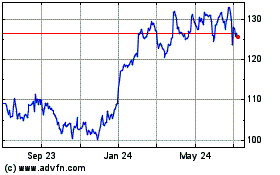

Merck (NYSE:MRK)

Historical Stock Chart

From Mar 2024 to Apr 2024

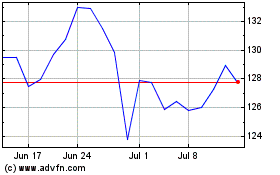

Merck (NYSE:MRK)

Historical Stock Chart

From Apr 2023 to Apr 2024