U.S. Hot Stocks: Hot Stocks to Watch

March 17 2016 - 9:21AM

Dow Jones News

Among the companies with shares expected to trade actively in

Thursday's session are Rofin-Sinar Technologies Inc. (RSTI),

Caterpillar Inc. (CAT), and Jabil Circuit Inc. (JBL).

Rofin-Sinar Technologies, a laser-products company contending

with a harsh proxy fight, has struck a $942 million deal to be

bought by Coherent Inc. (COHR). Shares of Rofin-Sinar jumped 35% to

$31.02 in premarket trading.

Caterpillar offered a downbeat revenue and profit forecast for

its first quarter, though it backed its full-year guidance, as the

company continues to see its business challenged by falling demand.

Shares slipped 2.7% to $72.35 premarket.

Jabil Circuit on Wednesday cuts its guidance for the year and

projected downbeat results for the current quarter, warning of

weaker demand in its mobility segment. Jabil makes products for

technology companies like Apple Inc. (AAPL), which accounted for

24% of its revenue last year. Shares of Jabil Circuit fell 6.6% to

$20.52 premarket.

Guess Inc. (GES) on Wednesday warned it would swing to a

first-quarter loss as it lays off workers as part of a broader

cost-cutting effort following a steeper-than-projected profit

decline during the holiday quarter. Shares fell 12% to $18.75

premarket.

FedEx Corp. (FDX) Chief Executive Frederick Smith on Wednesday

said the cost of e-commerce must go up to help support needed

expansion to handle the flood in packages. The comments came as

FedEx reported a 19% third-quarter profit decline largely due to

legal settlements regarding its former independent

contractor-driver model at its ground segment. Shares rose 5.7% to

$152.45 premarket.

Michaels Cos. (MIK) said profit rose 17% in the latest quarter

as sales easily topped forecasts, though the company warned its

business would continue to battle unfavorable exchange rates and a

weakened Canadian dollar.

Williams-Sonoma Inc. (WSM) on Wednesday gave downbeat

projections for the current quarter and year following

disappointing results in the holiday quarter, weighed down by a

comparable-sales decline at its Pottery Barn brand.

Herman Miller Inc.'s (MLHR) third-quarter profit rose 33%, as

the office-furniture company reported continued progress in its

North American business.

Royal Dutch Shell PLC (RDSA) and Saudi Arabian Oil Co., the

state oil company of Saudi Arabia, plan to split up Motiva

Enterprises LLC, breaking up a nearly two-decade business venture

that created the biggest crude refiner in the U.S.

Write to Jenny Roth at jenny.roth@wsj.com and Maria Armental at

maria.armental@wsj.com

(END) Dow Jones Newswires

March 17, 2016 09:06 ET (13:06 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

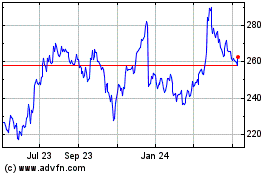

FedEx (NYSE:FDX)

Historical Stock Chart

From Mar 2024 to Apr 2024

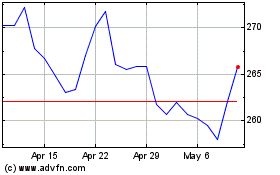

FedEx (NYSE:FDX)

Historical Stock Chart

From Apr 2023 to Apr 2024