Among the companies with shares expected to trade actively in

Wednesday's session are Textron Inc. (TXT), SunEdison (SUNE) and

Tupperware Brands Corp. (TUP).

Textron Inc. showed a surprise fourth-quarter revenue decline as

the manufacturer gave a cautious 2016 forecast which includes

below-consensus EPS growth. Shares fell 9.65% to $34.09 in

premarket trading.

SunEdison Inc. said Wednesday that it has agreed to give David

Einhorn's Greenlight Capital a seat on its board and amend its

corporate governance policies following a collapse in the

solar-power company's stock price. Shares rose 5.9% to $3.23

premarket.

Tupperware Brands Corp. gave downbeat guidance after posting a

worse-than-expected drop in sales as the stronger dollar continues

to dent results for the maker of plastic food ware with a heavy

overseas presence. Shares fell 11.6% to $45.51 premarket.

Boeing Co. (BA) on Wednesday gave 2016 guidance that fell well

short of Wall Street expectations, though the world's largest

aerospace company posted fourth-quarter profit that easily topped

analysts' views. Shares fell 5.91% to $120.45 premarket.

Biogen Inc. (BIIB) on Wednesday reported better-than-expected

results for its fourth quarter as sales of its multiple sclerosis

drug Tecfidera grew. Shares rose 5.09% to $273.10 premarket.

EMC Corp. (EMC), awaiting the completion of its acquisition by

Dell Inc., said profit in its latest quarter declined as a strong

dollar hit revenue and as the company booked merger and

restructuring charges. Shares fell 1.65% to $23.90 premarket.

State Street Corp. (STT) reported a decline in fourth quarter

revenue as weaker global equity markets dented the fees generated

by the trust bank.

United Technologies Corp. (UTX) on Wednesday reported revenue

declines among all four of its units as the company faced currency

headwinds and restructuring costs.

Hess Corp. (HES) deepened its loss in its fourth quarter amid

big drops in energy prices. The company, however, reaffirmed its

2016 production forecast, predicting 330,000 to 350,000 barrels of

oil equivalent per day.

Apple Inc. (AAPL) on Tuesday reported the slowest quarterly

iPhone sales increase since its introduction in 2007 and forecast

the steepest quarterly revenue decline in 15 years.

AT&T Inc. (T) on Tuesday reported a smaller-than-projected

revenue increase in the fourth quarter as it added fewer mainstream

wireless customers than a year earlier.

CA Inc. (CA) said earnings edged higher in the latest reporting

quarter, as lower expenses offset a decline in the

information-technology company's revenue.

Capital One Financial Corp. (COF) on Tuesday reported a 7.9%

profit decline in the fourth quarter, hurt by higher marketing and

operating expenses.

Health insurer Centene Corp.(CNC), which is merging with Health

Net Inc.(HNT), expects 2015 revenue at the top end of its

guidance.

Citizens Financial Group Inc. (CFG) will join the S&P 500 on

Friday after the market closes and RE/MAX Holdings Inc. is to join

the S&P SmallCap 600 after the close of trading on Feb. 2,

S&P Dow Jones Indices said Tuesday.

The former ACE Ltd. and Chubb Corp. each posted lower

fourth-quarter operating earnings on Tuesday, less than two weeks

after ACE completed its $29.5 billion acquisition of Chubb Corp.

and took the Chubb Ltd. (CB) name.

CMS Energy Corp. (CMS) said Tuesday that Chief Executive John

Russell will step down on July 1 and become its chairman. Patricia

Kessler Poppe, senior vice president for energy distribution, will

succeed Mr. Russell as president and CEO.

Ethan Allen Interiors Inc. (ETH) on Tuesday posted

stronger-than-expected results for its December quarter on higher

sales in its retail and wholesale segments.

FedEx Corp.'s (FDX) board on Tuesday authorized a new stock

repurchase program of up to 25 million shares, worth more than $3

billion.

International Business Machines Corp. (IBM) on Tuesday elected

Mark Fields, chief executive of Ford Motor Co., to its board of

directors. The appointment is effective March 1.

Molson Coors Brewing Co. (TAP) on Tuesday projected

fourth-quarter results mostly below analysts' expectations as the

brewer said its performance was hurt by currency impacts along with

the loss of the Modelo brands and Heineken brewing contracts in the

U.S.

Noble Energy Inc. (NBL) said Tuesday that it will cut its

dividend by 44% and slash capital spending in half this year as it

faces a prolonged slump in commodity prices.

Stryker Corp.'s (SYK) profit more than doubled in the December

quarter as sales topped its raised guidance.

Electronic payment processor TSYS (TSS) will buy payments

processor TransFirst for about $2.35 billion, a deal that would

expand its customer base but also pressure its debt load. After the

deal was announced Tuesday, Standard & Poor's Ratings Services

cut TSYS's credit and debt ratings by two notches to

triple-B-minus, just above so-called junk status.

Hedge fund Altimeter Capital and PAR Investment Partners on

Tuesday disclosed they are talking with United Continental Holdings

Inc. (UAL) over possible changes at the airline. The two firms

reported a combined 5.5% stake in the airline.

U.S. Steel Corp. (X) swung to a fourth-quarter loss and said it

faces "significant headwinds and uncertainty" in 2016.

Visteon Corp. (VC), a former division of Ford Motor Co., said

Tuesday that its chief financial officer will step down once a

successor is appointed. The company said it expects the search to

be completed by March 31.

VMware Inc.(VMW), seeking solid footing after being caught in

the middle of the massive Dell Inc.-EMC Corp. merger, said Tuesday

it was cutting some 800 positions and EMC's finance chief would

replace a key executive.

Wells Fargo & Co. (WFC) said Tuesday that its board approved

the repurchase of an additional 350 million shares of the San

Francisco-based bank's stock.

Write to Chris Wack at chris.wack@wsj.com and Maria Armental at

maria.armental@wsj.com

(END) Dow Jones Newswires

January 27, 2016 09:29 ET (14:29 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

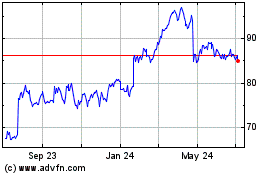

Textron (NYSE:TXT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Textron (NYSE:TXT)

Historical Stock Chart

From Apr 2023 to Apr 2024