U.S. Hot Stocks: Hot Stocks to Watch

December 22 2015 - 9:40AM

Dow Jones News

Among the companies with shares expected to trade actively in

Tuesday's session are General Electric Co. (GE), Express Scripts

Holding Co. (ESRX) and ConAgra Foods Inc. (CAG).

General Electric Co. said Monday it agreed to sell 23.3% of

Hyundai Capital Services to Hyundai Motor Co. and Kia Motors Corp.

and plans to sell its remaining 20% stake in the 11-year-old join

venture in the coming months. Shares were trading up 0.2% to $30.46

in premarket trading.

Express Scripts Holding Co., the largest U.S. pharmacy-benefit

manager, on Tuesday gave stronger-than-expected earnings guidance

for next year. Shares rose 3.05% to $89.81 premarket.

ConAgra Foods Inc. on Tuesday reported a dip in sales, though

cost cuts and the planned sale of its private-label business helped

drive adjusted profit above Wall Street expectations. Share rose

2.46% to $42.00 premarket.

Denbury Resources (DNR) sees its 2016 capital development

budget, excluding acquisitions, between $250 million and $300

million. Shares rose 4.23% to $1.97 premarket.

Cintas Corp. (CTAS) said its adjusted earnings rose in the

latest quarter, and the Cincinnati provider of uniform rentals and

services raised its outlook for the current fiscal year.

NetApp Inc. (NTAP) has agreed to buy data-storage startup

SolidFire Inc. for $870 million, adding a participant in a sector

that has gained prominence as many businesses turn to flash storage

rather than hard drives.

Steelcase Inc. (SCS) said its earnings soared in the latest

quarter thanks to lower one-time expenses related to a revamp of

the European segment's operations and stronger margins. However,

the office furniture and workspace systems company's adjusted

per-share earnings, revenue and guidance for the current quarter

missed expectations.

Western Refining Inc. (WNR) agreed to acquire the remaining

stake in Northern Tier Energy LP (NTI) that it doesn't already own

in a revised offer that values the master limited partnership at

$2.43 billion. Under the deal, Northern Tier unit holders would

receive $15 a unit in cash and 0.2986 Western Refining share for

each common unit held, or roughly $26.21 a unit based on Monday's

close. The offer represents a 7.9% premium to Northern Tier's

Monday close.

Write to Chris Wack at chris.wack@wsj.com and Tess Stynes at

tess.stynes@wsj.com

(END) Dow Jones Newswires

December 22, 2015 09:25 ET (14:25 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

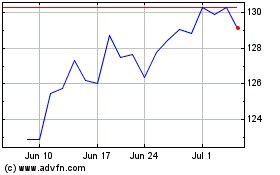

NetApp (NASDAQ:NTAP)

Historical Stock Chart

From Mar 2024 to Apr 2024

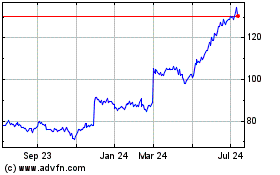

NetApp (NASDAQ:NTAP)

Historical Stock Chart

From Apr 2023 to Apr 2024