U.S. Hot Stocks: Hot Stocks to Watch

November 13 2015 - 9:40AM

Dow Jones News

Among the companies with shares expected to trade actively in

Friday's session are Tyco International Ltd. (TYC) and Edgewell

Personal Care Co. (EPC).

Tyco International Ltd.'s posted on Friday adjusted profit in

line with expectations for its September quarter, even as revenue

continued to be hurt by foreign currency impacts. Shares fell 2.74%

to $35.50 in premarket trading.

Edgewell Personal Care Co. said Friday that sales fell 14% in

its fourth quarter, the first reporting period since spinning off

its household-products business in the summer. Shares fell 8.25% to

$72.00 premarket.

Applied Materials Inc. (AMAT) on Thursday reported order growth

and a 31% jump in profit, helped by a smaller income-tax charge,

though revenue fell short of Wall Street expectations. Shares rose

3.75% $17.15 premarket.

Blue Buffalo Pet Products Inc. (BUFF) on Thursday reported an

11% sales increase in the third quarter, its first report as a

public company.

El Pollo Loco Holdings Inc. (LOCO) on Thursday lowered

expectations for the year after reporting a sharp drop in

third-quarter profit.

Nordstrom Inc. (JWN) on Thursday cut its projections for the

year as it reported disappointing third-quarter results following

the sale of its U.S. credit-card portfolio.

Party City Holdco Inc. (PRTY) on Thursday reported weak revenue

growth for its third quarter, weighed down by soft traffic, and the

company lowered a key sales forecast for the year.

Planet Fitness Inc. (PLNT) raised its 2015 guidance as the

budget fitness chain reported better-than-expected results for the

third quarter.

Time Inc. said Thursday it plans to start buying back $300

million of its stock and paying down $200 million in debt

regardless of the status of the sale of its London headquarters.

However, if the sale of the Blue Fin Building is delayed or falls

through, the company said Thursday, the stock and debt repurchases

"would likely correspondingly be delayed or adjusted."

Yum Brands Inc. (YUM) said sales at established stores in its

struggling China division rose 5% in October, compared with 6% the

previous month, led by a 9% decline in Pizza Hut. It was the

company's first monthly report since it said last month that it

plans to spin off the unit, which accounts for about half of its

sales and was once at the center of the its expansion plans.

Write to Chris Wack at chris.wack@wsj.com and Maria Armental at

maria.armental@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 13, 2015 09:25 ET (14:25 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

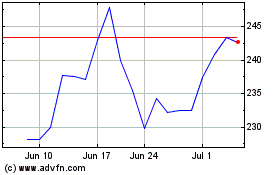

Applied Materials (NASDAQ:AMAT)

Historical Stock Chart

From Mar 2024 to Apr 2024

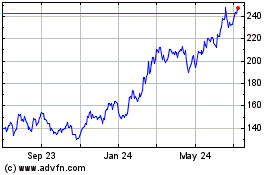

Applied Materials (NASDAQ:AMAT)

Historical Stock Chart

From Apr 2023 to Apr 2024