U.S. Hot Stocks: Hot Stocks to Watch

November 11 2015 - 9:42AM

Dow Jones News

Among the companies with shares expected to trade actively in

Wednesday's session are Platform Specialty Products Corp. (PAH),

J.C. Penney Company, Inc. (JCP) and Rockwell Collins (COL).

Platform Specialty Products Corp. said Tuesday that it swung to

a loss in the third quarter, as the acquisitive chemical company

was hurt by a weaker agricultural specialty chemical market,

currency headwinds and a shift in the company's distribution

strategy. Shares were trading 2.31% lower at $11.41 in premarket

trading.

J.C. Penney Company, Inc. said Wednesday it had settled a class

action lawsuit filed in California in 2012 that accused the

retailer of false advertising. Shares rose 5.18% to $9.13

premarket.

Aviation company Rockwell Collins said Wednesday that Chief

Executive Kelly Ortberg was elected chairman of the company's

board. Shares were untraded premarket.

Genesee & Wyoming Inc. (GWR) reported its October freight

volume declined 15% on a same-railroad basis mostly on weaker

shipments of coal and metals. Shares were untraded premarket.

Horizon Pharma PLC (HZNP) on Wednesday fired back a response at

Express Scripts Holding Co.'s business practices after the largest

U.S. pharmacy-benefit manager said it was cutting off a pharmacy

that sold medications made by the biopharmaceutical company.

Horizon Pharma shares fell 16.49% to $18.69 premarket.

Kroger Co. (KR) on Wednesday agreed to buy Roundy's Inc. (RNDY)

for about $178 million in cash, as the grocery store chain

continues to add to its roster of supermarket chains. Kroger shares

rose 1.8% to $37.94 premarket, while Roundy's shares rose 64.22% to

$3.58 premarket.

Home security giant ADT Corp.'s fourth-quarter profit slid, even

as revenue improved slightly, helped by lower customer

cancellations.

Amdocs Ltd. (DOX) on Tuesday gave weak financial projections,

following a decline in fourth-quarter profit largely due to higher

costs tied to its Comverse Inc. acquisition.

Brunswick Corp. (BC) set a 2018 earnings target sharply higher

than what it expects to earn this year, as the maker of boats,

fitness equipment and pool tables said it expects to benefit from

improving marine markets.

Juno Therapeutics Inc. (JUNO) on Tuesday reported a narrower

adjusted loss for its third quarter, as its cash position improved

from the prior year due to Celgene Corp.'s $1 billion initial

investment in an ambitious cancer collaboration with the

biotechnology company.

Tesoro Corp. (TSO) has agreed to sell Los Angeles storage and

pipeline assets including 97 tanks to the master limited

partnership it formed in 2010. The refiner said the sale to Tesoro

Logistics LP (TLLP) is valued at $500 million, including about $250

million of cash and about $250 million of common and general

partner units.

Write to Chris Wack at chris.wack@wsj.com and Maria Armental at

maria.armental@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 11, 2015 09:27 ET (14:27 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

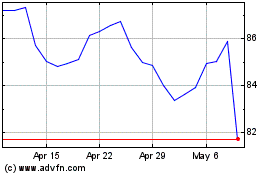

Amdocs (NASDAQ:DOX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Amdocs (NASDAQ:DOX)

Historical Stock Chart

From Apr 2023 to Apr 2024