U.S. Dollar Weakens As Retail Sales Disappoint

May 12 2017 - 5:32AM

RTTF2

The U.S. dollar dropped against its major counterparts in the

European session on Friday, along with treasury yields, following

the release of a data showing smaller than expected increase in

U.S. retail sales in April, which indicates a slowdown in economy

at the start of the second quarter.

Data from the Commerce Department showed that retail sales

climbed by 0.4 percent in April compared to economist estimates for

0.6 percent growth.

However, the report also said retail sales inched up by a

revised 0.1 percent in March versus the 0.2 percent drop originally

reported.

Excluding a rebound in auto sales, retail sales rose by 0.3

percent in April, matching the increase seen in the previous month

as well as economist estimates.

A separate report from the Labor Department showed that consumer

prices rebounded in line with economist estimates in the month of

April.

The Labor Department said its consumer price index rose by 0.2

percent in April after falling by 0.3 percent in March.

Excluding food and energy prices, core consumer prices inched up

by 0.1 percent in April after dipping by 0.1 percent in March. Core

prices had been expected to rise by 0.2 percent.

The treasury yields declined after the data, with the benchmark

yield on 10-year treasuries falling by 2.36 percent, while that of

2-year equivalent was lower by 1.31 percent. Yields move inversely

to bond prices.

Investors await the University of Michigan's preliminary

consumer sentiment index for May and business inventories for March

to assess the strength of the economy.

The greenback held steady against its major counterparts in the

Asian session.

Pulling away from an early high of 113.95 against the yen, the

greenback edged down to 113.52. The greenback is likely to find

support around the 112.00 zone.

Data from the Bank of Japan showed that Japan's M2 money stock

rose 4.3 percent on year in April, coming in at 975.5 trillion

yen.

That was in line with expectations and up from 4.2 percent in

March following a downward revision from 4.3 percent.

The greenback retreated to 1.2888 against the pound, from an

8-day high of 1.2844 hit at 8:15 am ET. On the downside, 1.30 is

possibly seen as the next support level for the greenback.

The greenback reversed from an early high of 1.0086 against the

Swiss franc, edging lower to a 2-day low of 1.0055. Continuation of

the greenback-franc's downtrend may see it challenging support

around 0.99 the mark.

The greenback weakened to a 3-day low of 1.0912 against the

euro, after having advanced to 1.0856 at 3:00 am ET. If the

greenback extends slide, 1.12 is possibly seen as its next support

level.

Figures from Eurostat showed that Eurozone industrial production

decreased for the second straight month in March on weak energy

output.

Industrial output slid unexpectedly by 0.1 percent

month-on-month in March, the same pace of growth as seen in

February. Production was forecast to climb 0.3 percent.

The greenback pared gains to 1.3682 against the loonie and

0.6868 against the kiwi, from its early highs of 1.3742 and 0.6827,

respectively. On the downside, 1.35 and 0.70 are likely seen as the

next support levels for the greenback against the loonie and the

kiwi, respectively.

The greenback that ended Thursday's trading at 0.7379 against

the aussie declined to a 4-day low of 0.7417. The greenback is

poised to target support around the 0.76 mark.

Looking ahead, U.S. business inventories for March and

University of Michigan's preliminary consumer sentiment index for

May are set for release shortly.

Philadelphia Fed President Patrick Harker speaks about the

economic outlook at Drexel University, in Philadelphia at 12:30 pm

ET.

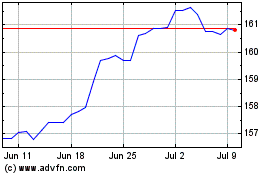

US Dollar vs Yen (FX:USDJPY)

Forex Chart

From Mar 2024 to Apr 2024

US Dollar vs Yen (FX:USDJPY)

Forex Chart

From Apr 2023 to Apr 2024