U.S. Dollar Weakens Amid Trump Controversy

May 16 2017 - 12:04AM

RTTF2

The U.S. dollar declined against its major counterparts in early

European deals on Tuesday, as investors became cautious over news

that the U.S. Donald Trump had reportedly disclosed highly

classified information to Russian officials during a meeting last

week, eroding his support from Republicans and putting his economic

agenda in trouble.

The Washington Post reported on Monday that Trump revealed a

classified information about a planned Islamic State operation to

Russian Foreign Minister Sergei Lavrov and Russian Ambassador

Sergei Kislyak, which had been tightly restricted within the United

States government and among close US allies.

The information shared with the Russians, according to the

Washington Post report, is said to have endangered cooperation from

the U.S. ally that had access to the inner workings of the Islamic

State.

Further weighing on the currency was a disappointing report on

New York Fed's Empire Manufacturing survey in May, which came on

the heels of weak retail sales and inflation data on Friday.

According to the CME FedWatch Tool, the likelihood of a 25 basis

point hike in June had dropped to 70 percent following the

report.

The U.S. treasury yields declined, with the benchmark yield on

10-year treasuries falling 2.33 percent, while that of 2-year

equivalent was down by 1.30 percent. Yields move inversely to bond

prices.

Investors await reports on housing market and industrial

production later in the day for more clues about the economy.

The currency was lower against its major rivals on Friday, with

the exception of the yen.

The greenback that closed yesterday's trading at 1.2894 against

the pound declined to 1.2933. The next possible support for the

greenback is seen around the 1.30 region.

The greenback slid to 1.1036 against the euro, its lowest since

November 2016. Continuation of the greenback's downtrend may see it

challenging support around the 1.115 area.

The greenback weakened to an 8-day low of 0.9923 against the

Swiss franc, compared to 0.9965 hit late New York Monday. The

greenback is seen finding support around the 0.97 mark.

The greenback reversed from an early high of 113.79 against the

yen, edging down to 113.25. If the greenback-yen pair extends

decline, it may locate support around the 112.5 level.

Figures from the Ministry of Economy, Trade and Industry showed

that Japan's tertiary activity index decreased unexpectedly in

March.

The tertiary activity index dropped 0.2 percent month-over-month

in March, after remaining flat in February. Meanwhile, economists

had expected a 0.1 percent increase for the month.

The greenback retreated to 1.3606 against the loonie and 0.7431

against the aussie, from its early highs of 1.3638 and 0.7405,

respectively. On the downside, 1.33 and 0.755 are possibly seen as

the next support levels for the greenback against the loonie and

the aussie, respectively.

Looking ahead, U.K. consumer and producer prices for April and

house price index for March, German ZEW economic sentiment index

for May, Eurozone GDP data for the first quarter and trade data for

March are due shortly.

In the New York session, U.S. building permits, housing starts

and industrial production for April are set for release.

At 11:30 am ET, the European Central Bank Governing Council

member Ewald Nowotny speaks about monetary policy at an event

hosted by the Principality of Liechtenstein, in Vienna.

The European Central Bank board member Benoit Coeure speaks at

the annual dinner of the ECB's Bond Market Contact Group in

Frankfurt, Germany at 1:00 pm ET.

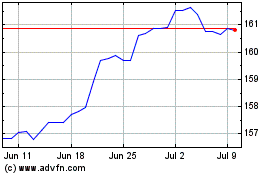

US Dollar vs Yen (FX:USDJPY)

Forex Chart

From Mar 2024 to Apr 2024

US Dollar vs Yen (FX:USDJPY)

Forex Chart

From Apr 2023 to Apr 2024