U.S. Dollar Strengthens On Fed Minutes

January 03 2013 - 10:25PM

RTTF2

In early Asian deals on Friday, the U.S. dollar outperformed

against other major currencies as traders purchased the currency in

response to the Federal Reserve's minutes of latest meeting, which

indicated that the policymakers were concerned about continuing to

extend the bond purchase purchase program.

The minutes showed that several members said it would probably

be appropriate to slow or stop the central bank's asset purchases

well before the end of 2013. The members cited concerns about

financial stability or the size of the balance sheet.

At the December meeting, the Fed kept rates near zero and

decided to expand their quantitative easing program by adding $45

billion of monthly Treasury purchases. Two months before, the Fed

began buying $40 billion per month in mortgage-related debt.

The greenback strengthened to near 2-1/2-year high of 87.78

against the yen, adding 0.61 percent from Thursday's close of

87.25. The next upside target level for the greenback-yen pair is

seen at 90.00.

Japan's service sector activity expanded at a slightly faster

pace in December, a survey by Markit Economics revealed. At the

same time, confidence among service providers hit its highest level

in five years.

The headline Business Activity Index recorded a level of 51.5 in

December, up slightly from 51.4 in the previous month.

Against the franc, the greenback hit more than a 3-week high of

0.9289 with 0.932 seen as the next resistance level. The pair

closed Thursday's trading at 0.9270.

The greenback is trading at a 2-day high of 0.9895 against the

loonie, up 0.15 percent from Thursday's closing value of 0.9880.

The next upside target level for the greenback-loonie pair is seen

at 0.995.

The greenback that closed Thursday's deals at 1.3050 against the

euro advanced to 1.3021, its highest level since December 12. If

the greenback extends gain, it may break 1.295 level.

Against the aussie and the kiwi, the U.S. currency is trading at

a 2-day high of 1.0435 and a 4-day high of 0.8231 and the next

likely upside target levels for the greenback are seen at 1.04 and

0.82, respectively. At yesterday's close, the greenback was worth

1.0469 against the aussie and 0.8283 against the kiwi.

The greenback that spiked up to more than a 3-week high of

1.6057 against the pound stabilised thereafter. On the upside, the

greenback may seek 1.60 as next target level. The pair closed

yesterday's deals at 1.6110.

Looking ahead, German retail sales for November, PMIs from major

European economies for December, U.K. mortgage approvals for

November and Eurozone CPI for December are due in the European

session.

Canada jobs data for December, industrial product price index

for November, U.S. jobs data for December, factory orders for

November and ISM non-manufacturing composite index for December are

likely to influence trading in the New York session.

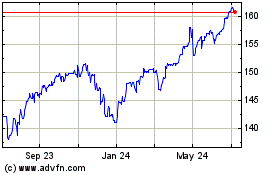

US Dollar vs Yen (FX:USDJPY)

Forex Chart

From Mar 2024 to Apr 2024

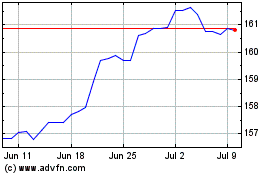

US Dollar vs Yen (FX:USDJPY)

Forex Chart

From Apr 2023 to Apr 2024