U.S. Dollar Strengthens After Strong Economic Data

May 11 2017 - 5:48AM

RTTF2

The U.S. dollar climbed against most major opponents in the

European session on Thursday, as encouraging reports on producer

prices and weekly jobless claims backed hopes for a Fed rate hike

as early as next month.

Data released by the Labor Department showed that U.S. producer

prices rose more than anticipated in the month of April.

The Labor Department said its producer price index for final

demand climbed by 0.5 percent in April after edging down by 0.1

percent in March. Economists had expected prices to rise by 0.2

percent.

Excluding increases in food and energy prices, core producer

prices still rose by 0.4 percent in April after coming in unchanged

in March. Core prices had been expected to edge up by 0.2

percent.

Separate data from the Labor Department showed that first-time

claims for U.S. unemployment benefits unexpectedly edged lower in

the week ended May 6th.

The report said initial jobless claims dipped to 236,000, a

decrease of 2,000 from the previous week's unrevised level of

238,000. Economists had expected jobless claims to rise to

245,000.

Further underpinning the currency were comments by Boston Fed

President Eric Rosengren, who called for three more rate this year

to avoid risks of an "over-hot economy."

"With conditions now consistent with full employment and the

Fed's inflation target, in my view, monetary policymakers should

certainly continue on the path of gradual normalization, and

continue to explore its pace," Rosengren said at a speech to

central Vermont Chamber of Commerce on Wednesday.

The U.S. treasury yields firmed with the benchmark yield on

10-year note rising 2.4 percent, while that of 2-year equivalent

was up by 1.37 percent. Yields move inversely to bond prices.

Investors await an auction of 30-year bonds worth $15 billion,

due later in the day.

The greenback showed mixed performance in the Asian session.

While the currency held steady against the pound and the euro, it

rose against the franc. Against the yen, it slipped.

The greenback firmed to 1.0100 against the Swiss franc, highest

since April 10. The next possible upside target for the

greenback-franc pair is seen around the 1.02 level.

The greenback climbed to a weekly high of 1.2849 against the

pound and more than 2-week high of 1.0839 against the euro, from

its early lows of 1.2948 and 1.0893, respectively. If the greenback

extends rally, it may locate resistance around 1.26 against the

pound and 1.07 against the euro.

The greenback advanced to a 6-day high of 1.3770 against the

loonie, off its early low of 1.3651. On the upside, 1.39 is

possibly seen as the next resistance level for the greenback-loonie

pair.

The greenback rose back to 0.6828 against the kiwi, not far from

a 1-year peak of 0.6818 set early in the Asian session. The pair

closed Wednesday's trading at 0.6926. The greenback is seen finding

resistance around the 0.66 area.

The Reserve Bank of New Zealand maintained its Official Cash

Rate at the record low of 1.75 percent. The decision was in line

with expectations following a rate cut in November.

On the flip side, the greenback pulled away from an early nearly

2-month high of 114.37 against the yen and edged down to 113.84.

Further weakness may take the greenback to a support around the

112.00 level.

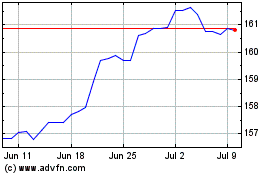

US Dollar vs Yen (FX:USDJPY)

Forex Chart

From Mar 2024 to Apr 2024

US Dollar vs Yen (FX:USDJPY)

Forex Chart

From Apr 2023 to Apr 2024