U.S. Dollar Slides Against Majors

November 23 2015 - 7:20PM

RTTF2

The U.S. dollar weakened against the other major currencies in

the Asian session on Tuesday amid profit taking following its

recent gains.

Data from the National Association of Realtors showed on Monday

that existing home sales fell 3.4 percent to an annual rate of 5.36

million in October after surging up 4.7 percent to a rate of 5.55

million in September. Economists had expected sales to drop to a

rate of 5.40 million.

Also, data from Markit showed that the U.S. flash manufacturing

PMI fell to a reading of 52.6 in November, from 54.1 in October.

This marked the lowest level in 25 months.

Meanwhile, gold recovered from yesterday's multi-year low. Spot

gold rose US$1,070.00 an ounce. Also, crude oil for January

delivery are currently up $0.22 to $41.97 a barrel.

Crude oil prices rose after Saudi Arabia signaled that it is

ready to co-operate with OPEC and non-OPEC producers to preserve

price stability in oil markets. Markets speculate the Federal

Reserve will announce an interest rate hike at its December

meeting. At the same time, the European Central Bank is widely

expected to announce further stimulus measures at its next

meeting.

Monday, the U.S. dollar rose in the wake of comments from

Federal Reserve officials about the prospect of a U.S. rate hike in

December. The U.S. dollar rose 0.06 percent against the euro, 0.42

percent against the pound, 0.26 percent against the Swiss franc and

0.16 percent against the yen.

In the Asian trading, the U.S. dollar fell to a 5-day low of

122.67 against the yen and a 4-day low of 1.0169 against the Swiss

franc, from yesterday's closing quotes of 122.84 and 1.0179,

respectively. If the greenback extends its downtrend, it is likely

to find support around 121.00 against the yen and 1.00 against the

franc.

Against the euro and the pound, the greenback dropped to 1.0645

and 1.5139 from yesterday's closing quotes of 1.0635 and 1.5122,

respectively. The greenback is likely to find support around the

1.08 against the euro and 1.53 against the pound.

Against the commodity currencies such as the Australian, the New

Zealand and the Canadian dollars, the greenback dropped to 0.7207,

0.6537 and 1.3341 from yesterday's closing quotes of 0.7191, 0.6517

and 1.3364, respectively. On the downside, 0.73 against the aussie,

0.67 against the kiwi and 1.31 against the loonie are seen as the

next support levels for the greenback. Looking ahead, final German

GDP data for the third quarter is due to be released in the

pre-European session oat 2:00 am ET.

The German Ifo business climate index for November is slated for

release later in the day.

At 4:05 am ET, Reserve Bank of Australia Governor Glenn Stevens

is expected to speak about issues in economic policy at the

Australian Business Economists Annual Dinner in Sydney.

At 5:00 am ET, Bank of England Governor Mark Carney and other

policymakers Andy Haldane, Gertjan Vlieghe and Kristin Forbes

appear before British parliament's Treasury Committee in

London.

Bank of France new chief Francois Villeroy de Galhau holds news

conference on new 20-euro banknote in Paris at 5:30 am ET.

In the New York session, preliminary third quarter U.S. GDP

data, U.S. S&P/Case-Shiller home price index for September,

U.S. Richmond Fed manufacturing index for November and U.S.

consumer confidence index for November are set to be announced.

At 3:30 pm ET, Bank of Canada Deputy Governor Lynn Patterson

will give a presentation as part of the bank's regional outreach

program at the University of Regina in Canada.

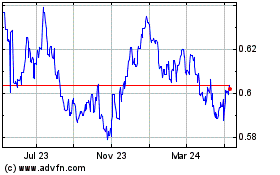

NZD vs US Dollar (FX:NZDUSD)

Forex Chart

From Mar 2024 to Apr 2024

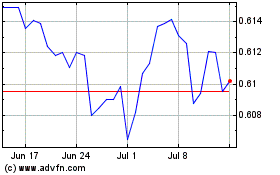

NZD vs US Dollar (FX:NZDUSD)

Forex Chart

From Apr 2023 to Apr 2024