U.S. Dollar Rises On Fed Rate Hike Talks, Risk Aversion

May 03 2016 - 10:35PM

RTTF2

The U.S. dollar strengthened against the other major currencies

in the Asian session on Wednesday, after several Fed officials

hinted at June rate hike, and as Asian stocks fell amid renewed

worries about global economic growth.

Fed officials on Tuesday hinted about considering U.S. interest

rate hike at next month's Fed meeting.

Atlanta Fed President Dennis Lockhart said a rate hike at the

next Federal Reserve policy meeting is "a real option" as long as

the economy, inflation and jobs show improvement. Cleveland Fed

President Loretta Mester and San Francisco Fed President John

Williams also supported U.S. rate hike policy.

Crude oil dropped further from recent yearly highs amid

speculation the rally was overdone. The global supply glut shows no

sign of abating, while U.S. crude oil inventories remain near

record highs.

OPEC nations and Russia are expected to keep pumping vast

amounts of oil in order to preserve market share, putting a cap on

oil's advance.

Tuesday, the U.S. dollar fell 0.69 percent against the euro,

0.49 percent against the pound, 0.03 percent against the Swiss

franc and 0.12 percent against the yen.

In the Asian trading, the U.S. dollar rose to a 1-week high of

1.4520 against the pound and a 5-day high of 107.44 against the

yen, from yesterday's closing quotes of 1.4534 and 106.55,

respectively. If the greenback extends its uptrend, it is likely to

find resistance around 1.43 against the pound and 111.50 against

the yen.

Against the euro and the Swiss franc, the greenback advanced to

2-day highs of 1.1477 and 0.9569 from yesterday's closing quotes of

1.1496 and 0.9541, respectively. The greenback may test resistance

near 1.13 against the euro and 0.98 against the franc.

Against the Australian, the New Zealand and the Canadian

dollars, the greenback climbed to nearly a 2-month high of 0.7467,

6-day high of 0.6876 and nearly a 2-week high of 1.2749 from

yesterday's closing quotes of 0.7484, 0.6913 and 1.2723,

respectively. The greenback is likely to find resistance around

0.73 against the aussie, 0.67 against the kiwi and 1.30 against the

loonie.

Looking ahead, PMI reports from major European economies for

April and Eurozone retail sales for March are due to be released

later in the day.

At 6:15 am ET, Germany's Bundesbank President Jens Weidmann is

expected to speak at annual meeting of the Asian Development Bank

in Frankfurt.

In the New York session, U.S. ADP private sector employment data

for April, ISM non-manufacturing PMI data for April, U.S and Canada

trade data for March, U.S. factory orders and durable goods orders

for March and U.S. crude oil inventories data are slated for

release.

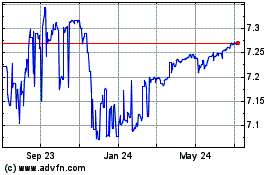

US Dollar vs CNY (FX:USDCNY)

Forex Chart

From Mar 2024 to Apr 2024

US Dollar vs CNY (FX:USDCNY)

Forex Chart

From Apr 2023 to Apr 2024