U.S. Dollar Rises After China's Rate Cut

March 02 2015 - 1:50AM

RTTF2

The U.S. dollar strengthened against the other major currencies

in the Asian session on Monday, as the U.S. bond yields rose after

Treasuries slipped on Chinese Central Bank rate cut.

The benchmark U.S. 10-year yield rose one basis point, or 0.01

percentage point, to 2.01 percent on Monday.

China's central bank announced its decision to lower its key

rates on Saturday. The bank cut its one-year lending rate by 0.25

percentage points to 5.35 percent. It reduced deposit rates by 0.25

percentage points to 2.5 percent.

This is expected to simulate the world's second-largest economy

amid concerns of slowing economic growth. The cut in rates came

into effect on Sunday.

A report on Friday showed that U.S. economic growth slowed by

even more than previously estimated in the final three months of

2014. The gross domestic product increased by a downwardly revised

2.2 percent in the fourth quarter compared to the previously

reported 2.6 percent growth. Despite the downward revision, the

pace of GDP growth during the fourth quarter still came in slightly

above economist estimates for a 2.1 percent increase.

Last Friday, the U.S. dollar rose 0.08 percent against the euro,

0.26 percent against the pound and 0.13 percent against the

yen.

In the Asian trading today, the U.S. dollar rose to 0.9558

against the Swiss franc for the first time since January 15. At

Friday's close, the greenback was trading at 0.9477 against the

franc. If the greenback extends its uptrend, it is likely to find

resistance around the 1.03 area.

The greenback, which ended Friday's deals at 119.57 against the

yen, strengthened to near a 3-week high of 119.94. The greenback is

likely to find resistance near the 122.13 region.

Data from Markit Economics showed that Japan's manufacturing

purchasing managers' index decreased to 51.6 in February from 52.2

in January.

The greenback appreciated to 1.1159 against the euro for the

first time since January 26. The pair was trading at 1.1206 at

Friday's close. On the upside, 1.10 is seen as the next resistance

level for the greenback.

The greenback edged up to 1.5391 against the pound, from

Friday's closing value of 1.5444. The greenback may test resistance

near the 1.51 area.

Looking ahead, final PMI reports from major European economies

for February, flash Eurozone CPI for February and unemployment rate

for January are due to be released in the European session.

In the New York session, U.S. personal income and spending data

for January and Canada current account for fourth-quarter are set

to be published.

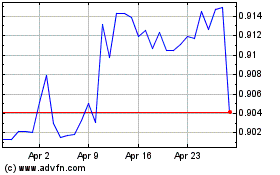

US Dollar vs CHF (FX:USDCHF)

Forex Chart

From Mar 2024 to Apr 2024

US Dollar vs CHF (FX:USDCHF)

Forex Chart

From Apr 2023 to Apr 2024