U.S. Dollar Recovers As Jobless Rate Declines To 8-year Low

February 05 2016 - 4:22AM

RTTF2

The U.S. dollar came off from recent losses against its major

counterparts in European deals on Friday, as jobless rate declined

in January to lowest since February 2008.

Data released from the Labor Department showed that the

unemployment rate edged down to 4.9 percent in January from 5.0

percent in December, while economists had expected the rate to come

in unchanged.

The unexpected decrease pulled the unemployment rate down to its

lowest level since a matching rate in February of 2008.

Meanwhile, the Labor Department said non-farm payroll employment

climbed by 151,000 jobs in January compared to economist estimates

for an increase of about 188,000 jobs.

In other economic news, the Commerce Department released a

report showing that the U.S. trade deficit widened more than

expected in December, driven by a rise in imports and fall in

exports.

The report said the trade deficit widened to $43.4 billion in

December from a revised $42.2 billion in November. The deficit has

been expected to widen to $43.0 billion.

But the dollar's rise was limited, as the traders no longer

expect the Fed to hike rates in March, given recent soft economic

indicators and tighter financial conditions that could alter the

U.S. growth outlook.

The greenback was trading mixed in Asian deals. While the

currency held steady against the yen, franc and the euro, it rose

against the pound.

The greenback, having fallen to more than a 2-week low of 116.29

against the Japanese yen in recent deals, rebounded to 117.31. The

next possible resistance for the greenback-yen pair is seen around

the 118.5 area.

Preliminary figures from the Cabinet Office showed that Japan's

leading index decreased more-than-expected to the weakest level in

nearly three years in December.

The leading index fell to 102.0 in December from 103.2 in the

previous month. Economists had forecast the index to drop to

102.7.

The greenback advanced to 0.9966 against the Swiss franc,

reversing from more than a 3-week low of 0.9880 hit in the

immediate aftermath of the data. If the greenback-franc pair

extends gain, 1.01 is possibly found as its next resistance

level.

The greenback reversed from an early 2-1/2-month low of 1.1244

against the euro, advancing to 1.1126. On the upside, 1.10 is

likely seen as the greenback's next resistance level.

Provisional data from Destatis showed that Germany's factory

orders declined more than expected in December.

Orders fell 0.7 percent in December from November, when it

advanced 1.5 percent. This was the first decrease in three months.

The pace of decline was faster than a 0.5 percent drop forecast by

economists.

The greenback strengthened to a 2-day high of 1.4458 against the

pound, coming off from its prior low of 1.4591. The greenback is

seen finding resistance around the 1.42 zone.

The Bank of England Deputy Governor Ben Broadbent said that

there is no urgency to raise U.K. interest rates at present and the

falling oil prices have benefited the economy, which is enjoying a

robust recovery.

There was "certainly no great urgency to raise rates at the

moment", Broadbent said in an interview on the BBC Radio 5.

The greenback climbed to 2-day highs of 0.7108 against the

aussie and 0.6631 against the kiwi, after having fallen to 0.7215

and a 5-week low of 0.6749, respectively in early deals. On the

upside, the greenback may locate resistance around 0.70 against the

aussie and 0.65 against the kiwi.

Looking ahead, Canada Ivey purchasing managers index for January

and U.S. consumer credit for December are set to be published

shortly.

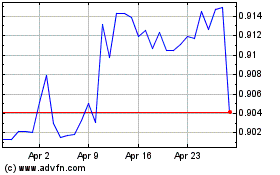

US Dollar vs CHF (FX:USDCHF)

Forex Chart

From Mar 2024 to Apr 2024

US Dollar vs CHF (FX:USDCHF)

Forex Chart

From Apr 2023 to Apr 2024