U.S. Dollar Extends Slide

May 02 2016 - 5:48AM

RTTF2

The U.S. dollar extended decline against its major counterparts

in European trading on Monday, as relentless decline in oil and a

slowdown in Chinese manufacturing activity in April arose concerns

over the global economy.

Crude oil fell on worries over supply growth after a report

showed OPEC countries are still producing oil at a record pace

despite relatively low prices.

Crude production by the Organization of the Petroleum Exporting

Countries rose in April to 32.64 million barrels per day.

Data released over the weekend showed that China's manufacturing

and service sector activities expanded less than the previous month

in April. Even though the data reinforced signs of a tepid economic

recovery, it raised doubts about the effect of recent stimulus

measures.

Investors focus on the non-farm payrolls report for April due on

Friday, ADP's private payrolls, considered precursor to the NFP

data, scheduled for release on Wednesday, the results of the

Institute for Supply Management's manufacturing and

non-manufacturing surveys for April scheduled for the week for more

clues about the economy.

The Federal Reserve's cautious stance on rate hike move and the

Bank of Japan's inaction to introduce more stimulus undermined the

currency last week. For the week, the dollar lost 2 percent against

the euro, 4.9 percent against the yen, 2 percent against the franc

and 1.44 against the pound.

The currency has been trading in a negative territory against

most major rivals in Asian trading, as the Fed dashed hopes for

imminent rate hike.

The greenback slipped to an 8-1/2-month low of 1.1501 against

the euro and near a 3-week low of 0.9563 against the franc, from

its early highs of 1.1448 and 0.9605, respectively. If the

greenback slides further, it may find support around 1.16 against

the euro and 0.94 against the franc.

The greenback dropped to 1.4696 against the pound, lowest since

January 5, from its previous high of 1.4581. Continuation of the

greenback's downtrend may take it to a support around the 1.48

mark.

The greenback edged down to 1.2513 against the loonie and 0.7654

against the aussie, reversing from its previous highs of 1.2559 and

0.7592,respectively. The greenback is seen finding support around

1.23 against the loonie and 0.78 against the aussie.

Extending early slide, the greenback fell to 0.7023 against the

kiwi, its lowest since April 20. On the downside, 0.72 is likely

seen as the next support level for the greenback.

On the flip side, the greenback that fell to 1-1/2-month low of

106.14 against the Japanese yen at the beginning of today's trading

rebounded over the course of the session and held steady

thereafter. The pair was trading at 106.72, compared to 106.28 hit

late New York Friday.

Survey figures from Markit Economics showed that Japan's

manufacturing activity deteriorated at the fastest pace in over

three years in April.

The Markit/ Nikkei Manufacturing Purchasing Managers' Index, or

PMI, fell to 48.2 in April from 49.1 in March.

Looking ahead, U.S. manufacturing PMI reports for April and

construction spending for March are due shortly.

At 10:00 am ET, the European Central Bank President Mario Draghi

speaks at the Asian Development Bank's 49th Annual Meeting, in

Frankfurt.

The Swiss National Bank Chairman Thomas Jordan will deliver a

speech about the euro and Swiss monetary policy at the Europa Forum

in Luzern at 12:30 pm ET.

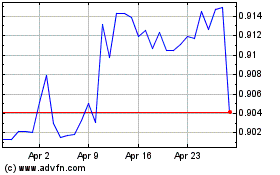

US Dollar vs CHF (FX:USDCHF)

Forex Chart

From Mar 2024 to Apr 2024

US Dollar vs CHF (FX:USDCHF)

Forex Chart

From Apr 2023 to Apr 2024