U.S. Dollar Extends Slide

April 28 2016 - 10:43PM

RTTF2

The U.S. dollar weakened against the other major currencies in

the Asian session on Friday, as the U.S. economic growth slowed

more forecasts in the first quarter.

Data from the Commerce Department showed on Thursday that the

U.S. gross domestic product rose by 0.5 percent in the first

quarter compared to the 1.4 percent increase in the fourth quarter.

Economists had expected the pace of growth to slow to 0.7

percent.

After reporting U.S. initial jobless claims at their lowest

level in over forty years in the previous week, the Labor

Department released a report on Thursday showing that jobless

claims rebounded in the week ended April 23rd.

The report said initial jobless claims rose to 257,000, an

increase of 9,000 from the previous week's revised level of

248,000. Economists had expected claims to climb to 260,000.

Thursday, the U.S. dollar fell 0.06 percent against the euro,

0.01 percent against the pound, 3.00 percent against the yen and

0.45 percent against the Swiss franc.

In the Asian trading, the U.S. dollar fell to a 1-1/2-year low

of 107.08 against the yen and nearly a 3-month low of 1.4654

against the pound, from yesterday's closing quotes of 108.08 and

1.4603, respectively. If the greenback extends its downtrend, it is

likely to find support around 106.00 against the yen and 1.47

against the pound.

The greenback dropped to an 8-day low of 1.1389 against the euro

and a 9-day low of 0.9638 against the Swiss franc, from yesterday's

closing quotes of 1.1348 and 0.9665, respectively. On the downside,

1.15 against the euro, 0.95 against the franc are seen as the next

support levels for the greenback.

Against the Australian, the New Zealand and the Canadian

dollars, the greenback edged down to 0.7653, 0.6988 and 1.2519 from

yesterday's closing quotes of 0.7623, 0.6957 and 1.2554,

respectively. The greenback is likely to find support around 0.78

against the aussie, 0.70 against the kiwi and 1.24 against the

loonie.

Looking ahead, Swiss KOF leading indicator for April, BOE U.K.

mortgage approvals for March, U.K. M4 money supply data for March,

Eurozone core CPI data for April, preliminary eurozone GDP data for

the first quarter and eurozone unemployment data for March are

slated for release later in the day.

In the New York session, Canada GDP data for February,

industrial product and raw materials price indexes for March, U.S.

personal income and spending data for March, U.S. Chicago PMI for

April and the University of Michigan's final U.S. consumer

sentiment index for April are set to be published.

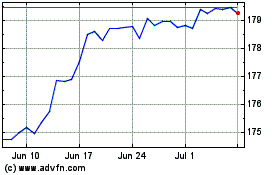

CHF vs Yen (FX:CHFJPY)

Forex Chart

From Mar 2024 to Apr 2024

CHF vs Yen (FX:CHFJPY)

Forex Chart

From Apr 2023 to Apr 2024