U.S. Dollar Extends Gain

March 04 2015 - 2:43AM

RTTF2

The U.S. dollar continued its early advance against the other

major currencies in the Asian session on Wednesday, as traders

awaited U.S. jobs data and the European Central Bank meeting due

this week.

The U.S. jobs data for February is slated for release on Friday.

Economists expect the unemployment rate to fall 5.6 percent in

February, compared to 5.7 percent in January.

A strong reading could prompt the Federal Reserve to hike rates

soon. Meanwhile, uncertainty over whether the U.S. Federal Reserve

will start raising interest rates by mid-year or wait a while

longer remain.

Some economists expect the Fed will quit the word "patient" in

its forward guidance at its policy meeting on March 17-18,

supporting the way for a possible rate hike in June.

Traders also look forward to the release of the ADP employment

report and the ISM non-manufacturing report due later in the day,

as well as the weekly jobless claims data on Thursday.

The European Central Bank policy makers are due to meet in

Cyprus for a 2-day monetary policy meeting on Thursday. Traders

focus on the commencement of the bank's quantitative easing

program. The bank will provide further details on its 1 trillion

euro ($1.118 trillion) government bond-buying program, which begins

this month.

Tuesday, the U.S. dollar rose 0.07 percent against the euro,

0.05 percent against the pound, 0.20 percent against the Swiss

franc and 0.05 percent against the yen.

In the Asian trading today, the U.S. dollar rose to more than

1-1/2-month high of 0.9627 against the Swiss franc, from

yesterday's closing value of 0.9608. On the upside, 1.02 is seen as

the next resistance level for the greenback.

Against the euro and the pound, the greenback edged up to 1.1164

and 1.5344 from yesterday's closing quotes of 1.1174 and 1.5355,

respectively. If the greenback extends its uptrend, it is likely to

find resistance around 1.10 against the euro and 1.51 against the

pound.

Moving away from an early low of 119.48 against the yen, the

greenback edged up to 119.77. The greenback is likely to find

resistance around the 122.05 region.

The greenback edged up to 1.2506 against the Canadian dollar. At

yesterday's close, the greenback was trading at 1.2494 against the

loonie. The greenback may test resistance near the 1.28 region.

Looking ahead, PMI reports from major European economies for

February and Eurzone retail sales data for January are due to be

released in the European session.

In the New York session, Markit's U.S. PMI, ISM U.S.

non-manufacturing PMI and private sector employment report - all

for February are slated for release.

At 9:00 am ET, U.S. Federal Reserve Bank of Chicago President

Charles Evans will deliver a speech about the economic outlook and

monetary policy at the Lake Forest-Lake Bluff Rotary Club 2015

Economic Breakfast in Lake Forest.

Around 45 minutes later, Bank of England's Deputy Governor

Andrew Bailey is expected to speak on currency at Treasury

Committee Hearing, U.K.

The Bank of Canada will announce its interest rate decision at

10:00 am ET. Economists expect the bank to retain interest rates

unchanged at 0.75 percent.

At 2:00 pm ET, U.S. Federal Reserve releases Beige Book

report.

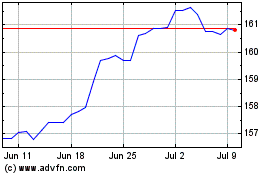

US Dollar vs Yen (FX:USDJPY)

Forex Chart

From Mar 2024 to Apr 2024

US Dollar vs Yen (FX:USDJPY)

Forex Chart

From Apr 2023 to Apr 2024