U.S. Dollar Declines Against Most Majors

January 21 2015 - 9:33AM

RTTF2

The U.S. dollar slipped against most major currencies in early

New York deals on Wednesday, on the back of disappointing earnings

results.

The chip maker AMD reported lower-than-expected earnings in the

fourth quarter and gave lackluster revenue guidance for the first

quarter.

Shares of IBM fell after the tech giant reported that its

fourth-quarter revenues missed estimates and provided disappointing

guidance for the year.

Economic data released today was mixed. While the U.S. building

permits fell below forecasts in December, housing starts improved

in the same month.

The report from the U.S. Commerce Department showed that housing

starts jumped 4.4 percent to an annual rate of 1.089 million in

December from the revised November estimate of 1.043 million.

Economists had expected housing starts to climb 1.3 percent to

1.041 million in December from the 1.028 million originally

reported for the previous month.

The dollar got boost yesterday, after the International Monetary

Fund raised the U.S. growth estimate for 2015. The agency upgraded

growth forecast to 3.6 percent from 3.1 percent for the U.S., while

cutting growth view for nearly all major economies. Hopes for

higher interest rates in the U.S., compared to most other major

economies have seen a sharp rally in dollar bulls since last

year.

Extending early slide, the greenback slipped to a 2-day low of

117.22 against the Japanese yen, compared to 118.78 hit at

Tuesday's close. On the downside, 115.00 is seen as the greenback's

next support level.

The Bank of Japan announced its decision to leave its monetary

policy unchanged in its January meeting today.

The bank decided by a 8-1 vote to maintain its target of raising

the monetary base at an annual pace of about JPY 80 trillion.

The greenback that ended yesterday's trading at 0.8751 against

the Swiss franc weakened to a 2-day low of 0.8561. If the greenback

continues slide, it may find support around the 0.84 zone.

The greenback dropped to a 2-day low of 1.1636 against the euro,

after having advanced to 1.1540 at 7:00 pm ET. The next possible

support for the greenback is seen around the 1.20 zone.

The greenback held steady against the pound, following an

advance to 1.5075 in early European deals. The pair ended

yesterday's trading at 1.5141.

Policymakers of the Bank of England unanimously decided to leave

the key rate unchanged for the first time in six months, according

to the minutes.

The Monetary Policy Committee governed by Mark Carney voted 9-0

to retain the base rate at 0.50 percent, it showed.

Looking ahead, the Bank of Canada's interest rate decision is

due shortly. The bank is seen keeping rates on hold at 1.00

percent.

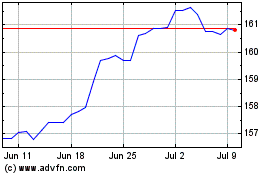

US Dollar vs Yen (FX:USDJPY)

Forex Chart

From Mar 2024 to Apr 2024

US Dollar vs Yen (FX:USDJPY)

Forex Chart

From Apr 2023 to Apr 2024