U.S. Dollar Declines Against Majors

December 27 2017 - 2:28AM

RTTF2

The U.S. dollar fell against its major counterparts in the

European session on Wednesday amid subdued trading in a

holiday-shortened week.

Trading volumes were light, as many traders were still away from

their desks following Christmas.

Investors await U.S. pending home sales and consumer confidence

figures later in the day for more clues about the economy.

Concerns over U.S. growth prospects also weighed, as investors

pondered over the impact of tax reform, which would add to federal

budget deficit.

The United States on Tuesday issued sanctions against two North

Korean officials who are believed to be behind their ballistic

missile programs. The latest sanctions grant power to seize any

property or interests they might have within U.S. jurisdiction and

prohibit any dealings by U.S. citizens with them.

The currency has been trading in a negative territory in the

Asian session.

The greenback retreated to 113.20 against the yen, from an early

2-day high of 113.38. If the greenback slides further, 111.00 is

likely seen as its next support level.

Data from the Ministry of Land, Infrastructure, Transport and

Tourism showed that Japan's housing starts declined at a

slower-than-expected pace in November.

Housing starts fell 0.4 percent year-on-year in November, much

slower than October's 4.8 percent decrease.

The greenback was trading in a negative territory against the

franc with the pair worth 0.9890. This may be compared to an early

session's low of 0.9886. The next possible support for the

greenback is seen around the 0.97 region.

Data from the investment bank UBS showed that Swiss consumption

indicator dropped slightly in November, but remained above its

long-term average.

The consumption index edged down to 1.67 in November from 1.68

in the previous month.

The greenback slipped to near a 2-week low of 1.3423 against the

pound, off its previous high of 1.3368. Continuation of the

greenback's downtrend may see it challenging support around the

1.38 region.

The greenback declined to a weekly low of 1.1895 against the

euro and more than a 3-week low of 1.2637 versus the loonie, from

its early highs of 1.1855 and 1.2696, respectively. On the

downside, 1.20 and 1.25 are likely seen as the next possible

support for the greenback against the euro and the loonie,

respectively.

The greenback weakened to more than a 2-month low of 0.7773

against the aussie and a 2-1/2-month low of 0.7075 against the

kiwi, off its prior highs of 0.7723 and 0.7029, respectively. The

greenback is seen finding support around 0.79 versus the aussie and

0.72 against the kiwi.

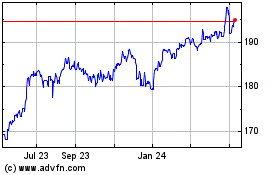

Sterling vs Yen (FX:GBPJPY)

Forex Chart

From Mar 2024 to Apr 2024

Sterling vs Yen (FX:GBPJPY)

Forex Chart

From Apr 2023 to Apr 2024