U.S. Dollar Climbs Ahead Of Fed Chair Yellen's Testimony

September 28 2016 - 1:24AM

RTTF2

The U.S. dollar drifted higher against the other major

currencies in early European trading on Wednesday, as investors

focus on semi-annual testimony by the Fed Chair Janet Yellen later

in the day, which could give more clues about the Fed's outlook on

rates and the economy.

Janet Yellen is scheduled to testify before the House Financial

Services Committee at 10:00 am ET and is expected signal over an

interest rate hike in December.

Besides Yellen, Cleveland Fed President Mester and Kansas City

Fed President George are due to speak at separate events, which

would offer insights on the economy and monetary policy.

Better-than-expected U.S. consumer confidence and Markit's flash

services PMI for September released overnight also underpinned the

currency.

San Francisco Fed President John Williams said on Tuesday that

the U.S. economy is able to withstand the implications of an

interest rate hike, as delaying things too long risks the economy

tipping into recession.

"It is getting harder and harder to justify interest rates being

so incredibly low given where the U.S. economy is and where it is

going," Williams told.

Fed Vice Chairman Stanley Fischer also said that U.S. interest

rates should rise over time.

The greenback showed mixed performance in the Asian session.

While the greenback rose against the yen and the pound, it held

steady against the euro and the Swiss franc.

The greenback bounced off to 100.82 against the Japanese yen,

from a low of 100.26 hit at 7:30 pm ET. Continuation of the

greenback's uptrend may see it finding resistance around the 103.00

zone.

Survey figures released by the Shoko Chukin Bank showed that

Japan's small business confidence improved more than expected in

September.

The small business sentiment indicator climbed to 47.7 in

September from 46.3 in the prior month. The reading stayed above

the expected level of 47.

The greenback rose to a 1-week high of 1.1182 against the euro

and a 5-day high of 0.9737 against the Swiss franc, from early lows

of 1.1219 and 0.9695, respectively. If the greenback extends its

uptrend, it is likely to find resistance around 1.10 against the

euro and 0.98 against the franc.

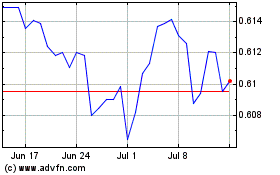

The greenback climbed to a 2-day high of 0.7251 against the

kiwi, following a decline to 0.7305 at 6:45 pm ET. The greenback is

seen finding resistance around the 0.70 level.

The greenback edged up to 1.3231 against the loonie, off its

early low of 1.3192. Further uptrend may see the greenback

challenging resistance around the 1.33 mark.

U.S. durable goods orders for August and U.S. crude oil

inventories data are set to be published in the New York

session.

At 10:00 am ET, Federal Reserve Chair Janet Yellen will testify

on supervision and regulation before the Committee on Financial

Services, in Washington DC.

Ten minutes later, Federal Reserve Bank of St. Louis President

James Bullard Fed Bank of Chicago President Charles Evans will

deliver speeches on the Community Banking in the 21st Century

Conference hosted by the Federal Reserve Bank of St. Louis.

At 10:30 am ET, European Central Bank President Mario Draghi is

expected to speak about current developments in the euro area at

the German Bundestag, in Berlin.

At 4:30 pm ET, Federal Reserve Bank of Cleveland President

Loretta Mester is scheduled to speak before the Greater Cleveland

Partnership, in Cleveland.

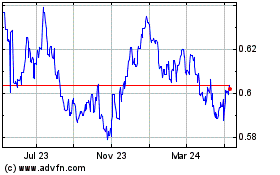

NZD vs US Dollar (FX:NZDUSD)

Forex Chart

From Mar 2024 to Apr 2024

NZD vs US Dollar (FX:NZDUSD)

Forex Chart

From Apr 2023 to Apr 2024