U.S. Dollar Advances On Fed Rate Hike Prospectus

July 24 2015 - 6:40AM

RTTF2

The U.S. dollar strengthened against European major counterparts

in European deals on Friday, amid heightening speculation for a Fed

rate hike at September meeting, on the back of upbeat weekly

jobless claims report released yesterday.

The Labor Department released a report on Thursday showing that

first-time claims for U.S. unemployment benefits tumbled to their

lowest level in over forty years in the week ended July 18th.

The report said initial jobless claims dropped to 255,000, from

the previous week's unrevised level of 281,000. Economists had

expected jobless claims to edge down to 279,000.

The Federal Reserve will meet next week, after hawish testimony

from chair Janet Yellen intensified hopes that the bank would hike

rates later this year. While it looks increasingly unlikely that

the Fed would hike rates next week, investors remain apprehensive

about the Fed taking a more hawkish turn.

Market participants will focus on durable goods orders, consumer

confidence index, pending home sales and gross domestic data, due

next week, for more indications about the growth of world's largest

economy.

The currency has been trading firm against its major rivals,

except the pound, in the previous session.

The greenback climbed to a 2-day high of 0.9624 versus the franc

and a 10-day high of 1.5466 against the pound, from Thursday's

closing values of 0.9584 and 1.5510, respectively. If the greenback

extends rise, it may challenge resistance around 0.97 against the

franc and 1.54 against the pound.

The greenback, which fell to 1.0995 versus the euro at 2:45 am

ET, rose to 1.0930. The pair ended yesterday's trading at 1.0981.

The greenback is seen finding resistance around the 1.08 mark.

The flash survey data from Markit Economics showed that Eurozone

economic growth slowed slightly in July but the pace of expansion

remained one of the strongest seen over the last four years.

The composite Purchasing Managers' Index fell to 53.7 in July

from June's four-year high of 54.2. The expected score was 54.

The greenback remained higher against the yen, trading at

123.97. Next key resistance for the greenback is seen around the

125.00 region.

The U.S. new home sales for June and flash Markit manufacturing

PMI for July are slated for release in the New York session.

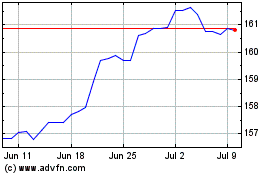

US Dollar vs Yen (FX:USDJPY)

Forex Chart

From Mar 2024 to Apr 2024

US Dollar vs Yen (FX:USDJPY)

Forex Chart

From Apr 2023 to Apr 2024