U.K.'s Budgets Will Suffer From an EU Exit, Study Says

May 25 2016 - 3:30AM

Dow Jones News

LONDON—A British vote in favor of leaving the European Union

could thwart U.K. Treasury chief George Osborne's goal of closing

the nation's budget deficit by 2020, according to an analysis by a

nonpartisan think tank.

The Institute for Fiscal Studies said it found that a vote to

leave the EU in a referendum next month would likely slow the

economy, lowering tax receipts and pushing up government spending

over the next few years, according to an advance copy of the

analysis.

That could cause government borrowing to be between £ 20 billion

($29 billion) and £ 40 billion higher in the fiscal year ending in

March 2020 than it is forecast to be if the U.K. remains an EU

member, according to the analysis. That would leave Mr. Osborne

some way from his self-imposed goal of closing the nation's budget

deficit completely that same fiscal year, meaning new spending cuts

or tax increases would be needed to close the gap.

The deficit was at £ 76 billion for the fiscal year that ended

in March.

The study comes amid a debate in Britain over the economic

consequences of leaving the EU, as Britons prepare for the June 23

vote.

Prime Minister David Cameron, a close ally of Mr. Osborne, says

an exit from the 28-member bloc would hurt trade and investment.

But backers of Britain's exit, or Brexit, argue that Britain would

ultimately benefit from being outside the EU, where it would be

free of burdensome EU regulation and able to sign its own trade

deals with faster-growing parts of the world.

The U.K. treasury said this week in a new analysis that the

British economy would likely experience "a profound shock" if

voters decide to quit the EU, potentially causing "a marked

deterioration in economic prosperity and security."

The treasury's assessment of the potential short-term costs of

Brexit comes on the heels of similar warnings from the Bank of

England, the International Monetary Fund and the Organization for

Economic Cooperation and Development, all of which concur that

leaving the EU could damage the U.K.'s economic prospects by

damping trade and slowing investment.

The Institute for Fiscal Studies' report, released Wednesday,

says the precise scale of the fiscal consequences of a British exit

is uncertain, and will depend on whether the U.K. continues to make

a contribution to the EU budget to maintain access to the bloc's

single market for goods and services. Its estimate of extra

borrowing costs over the next few years assume the U.K.'s annual

contribution to the EU budget, net of payments Britain receives, is

halved, to around £ 4 billion annually. That's a similar

arrangement to Norway, which isn't in the EU but does pay for

single market access.

The Brexit-backing group Vote Leave responded to the institute's

analysis by saying overstates the economic risks associated with

leaving the EU and ignores the risks of remaining a member, given

the economic problems of the 19-nation eurozone at the EU's

core.

Write to Jason Douglas at jason.douglas@wsj.com

(END) Dow Jones Newswires

May 25, 2016 03:15 ET (07:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

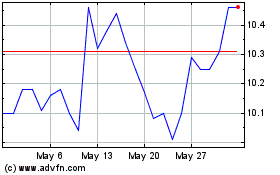

Pacific Current (ASX:PAC)

Historical Stock Chart

From Mar 2024 to Apr 2024

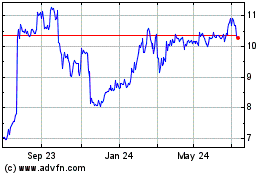

Pacific Current (ASX:PAC)

Historical Stock Chart

From Apr 2023 to Apr 2024