U.K. Treasury to Sell Gilts Amid Brexit Uncertainty

April 26 2016 - 6:40AM

Dow Jones News

The U.K. Treasury is looking to sell several billion pounds of

long-dated debt Tuesday, in a key test of investor appetite for

British government bonds ahead of the country's June vote on its

membership of the European Union.

While the potential for Britain to leave the EU, the so-called

Brexit, has put pressure on the pound, it has yet to hit trading in

government debt or the country's main equity market. This could

soon change, analysts say, leaving investors looking for signs of

market reaction.

The government's financing arm, the U.K. Debt Management Office,

is planning to add to an existing £ 4.75 billion ($6.87 billion)

bond issue that pays an interest rate of 2.5% and matures in 2065,

according to a deal notice released by banks underwriting the deal

Tuesday.

The deal notice said the sale would be of "benchmark size," and

provided price guidance of 0.25 to 0.5 percentage point over the

U.K.'s outstanding 2068 bonds. Those bonds have a yield of 2.24%,

according to Tradeweb. For the U.K. government, benchmark size

would typically refer to an issue of over £ 1 billion. The Debt

Management Office has said it plans to raise £ 9.5 billion of

long-dated bonds through syndicated bond sales in the fiscal year

to March 2017.

Citigroup Inc., Deutsche Bank AG, HSBC PLC and J.P. Morgan Chase

& Co. are underwriting the deal, which is expected to price

later Tuesday.

The June 23 vote has yet to hit U.K government bonds, also known

as gilts, which have moved alongside a global rally in sovereign

debt. Rising prices have pushed the yield on 10-year gilts around

0.34 percentage points lower to 1.62% this year. Government debt

rallied at the start of the year as investors looked for safety

amid an uncertain global outlook.

Still, yields have ticked up from a recent low of 1.32% on April

7, with investors now reassessing their outlook on the global

economy.

In the U.K., it is the pound that has borne the brunt of

investor uncertainty so far this year. The pound is down 1.2%

against the dollar and nearly 5% against the euro this year after

paring losses over the past several days.

Write to Christopher Whittall at

christopher.whittall@wsj.com

(END) Dow Jones Newswires

April 26, 2016 06:25 ET (10:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

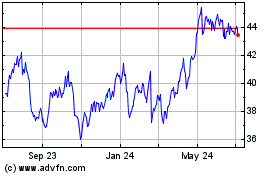

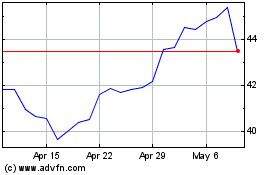

HSBC (NYSE:HSBC)

Historical Stock Chart

From Mar 2024 to Apr 2024

HSBC (NYSE:HSBC)

Historical Stock Chart

From Apr 2023 to Apr 2024