U.K., Irish Firms Agree $8 Billion Sports-Betting Merger

August 26 2015 - 5:40AM

Dow Jones News

LONDON—Paddy Power PLC and Betfair Group PLC have agreed to a

near $8 billion merger to create an international sports-betting

and online-gambling group with leading positions in the U.K., other

parts of Europe and Australia.

Shareholders in Dublin-listed Paddy Power would own 52% of the

merged company and receive an €80 million ($89.3 million) special

dividend, while London-listed Betfair's shareholders would own 48%,

the companies said on Wednesday.

Paddy Power is one of the largest bookmakers in the U.K.,

Ireland and Australia in revenue terms and operates in Italy,

France and Canada, according to its website. Betfair was launched

in the U.K. in 1999 and floated on the London Stock Exchange in

2010. The companies have combined revenue of around €1.5

billion.

News of the proposed tie-up comes amid a flurry of consolidation

in the sector, particularly in the U.K. where the government has

imposed a new tax on online gambling. Regulations for online

betting have also tightened elsewhere in Europe, constraining

growth and focusing companies' attention on how to lower costs.

Online gambling groups Bwin. Party Digital Entertainment PLC and

888 Holdings PLC announced a merger in July. Betting shop operator

Ladbrokes also said last month that it will merge with Gala Coral

in a stock deal that will create a betting and gaming company worth

around £ 2.3 billion ($3.7 billion).

Investors liked the odds of the Paddy Power-Betfair merger being

a success. Shares in Paddy Power rose more than 18% while Betfair

shares jumped 17% in early trading.

"The combined group's scale and capabilities would leave it

better placed to compete in existing and new markets," the

companies said. The companies plan to keep their separate brand

names.

The structure of the possible merger is still being completed

though the companies have agreed on who would run the combined

group, they said. Paddy Power Chairman Gary McGann would chair the

merged company whose chief executive would be Breon Corcoran,

currently Betfair's CEO.

Citi analyst James Wheatcroft said he wasn't surprised by the

proposed merger, which comes after the imposition of a new online

gambling tax in the U.K. The new levy has "triggered a financial

and strategic rationale" for consolidation in the sector, Mr.

Wheatcroft said.

Wednesday, Paddy Power also reported a 31% rise in pretax profit

for the six months ended June 30 to €80.5 million from €61.6

million the previous year and said full year operating profit is

"expected to be ahead of 2014 and the consensus market

forecast."

Betfair reported a 15% rise in revenue for the quarter ended

July 31 from the same period last year to £ 135.4 million.

Write to Rory Gallivan at rory.gallivan@wsj.com

Access Investor Kit for "London Stock Exchange Group Plc"

Visit

http://www.companyspotlight.com/partner?cp_code=P479&isin=GB00B0SWJX34

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

August 26, 2015 05:25 ET (09:25 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

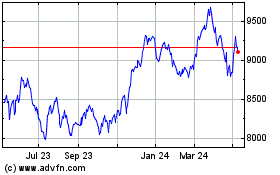

London Stock Exchange (LSE:LSEG)

Historical Stock Chart

From Mar 2024 to Apr 2024

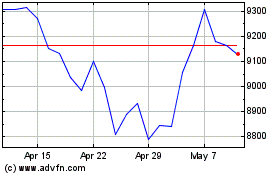

London Stock Exchange (LSE:LSEG)

Historical Stock Chart

From Apr 2023 to Apr 2024