U.K. Government Reduces Stake in Lloyds to 3.89%

February 23 2017 - 3:27AM

Dow Jones News

By Ian Walker

LONDON--U.K. government has further reduced its shareholding in

Lloyds Banking Group PLC (LLOY.LN) in which it now holds around a

3.89% stake.

No price was disclosed on Thursday for the share sale, which was

conducted on Wednesday.

The move is the latest in the government's planned piecemeal

sale of its remaining shares after it pulled a plan for retail

offering of the 9.1% stake it still held in the lender last

October.

Money raised from the sale of the government's holding in the

British bank has been earmarked for reducing national debt.

The U.K. Treasury said the latest sales of Lloyds stock mean the

government has recovered over 19 billion pounds ($23.6 billion) of

the GBP20.3 billion taxpayers injected into Lloyds during the

financial crisis, once share sales and dividends received are

accounted for.

"Lloyds' strong annual results show that we are in a good

position to continue to reduce our shareholding and recover all of

the money the tax-payer injected into the bank during the financial

crisis," said Economic Secretary to the Treasury, Simon Kirby.

Lloyds, the U.K.'s biggest retail bank, was bailed out by U.K.

taxpayers during the crisis, with the government originally taking

a 39% stake. The government started selling its shares in the bank

in late 2013.

On Wednesday, Lloyds reported a more than quadrupled net profit

to its highest level in a decade as the bank benefited from a steep

fall in conduct costs.

-Write to Ian Walker at ian.walker@wsj.com; @IanWalk40289749

(END) Dow Jones Newswires

February 23, 2017 03:12 ET (08:12 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

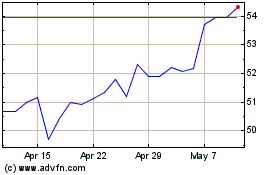

Lloyds Banking (LSE:LLOY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Lloyds Banking (LSE:LLOY)

Historical Stock Chart

From Apr 2023 to Apr 2024