U.K. Financial Firms Feel Emerging Market Pain

August 24 2015 - 1:41PM

Dow Jones News

By Max Colchester And Juliet Samuel

LONDON--U.K. banks and insurers that rode a wave of growth in

emerging markets in recent years now find themselves facing a sharp

downturn in those key markets.

Financial firms including Standard Chartered PLC, Prudential

PLC, Aviva PLC and HSBC Holdings PLC have long touted their

exposure to fast growing Asian markets. But the region's fortunes

are quickly turning sour, driven by concerns about weakness in

China.

Investors are selling off emerging market assets and pulling

money out of China on worries about the country's slowing growth

and the sudden devaluation of its currency. "The narrative around

weaker growth in China and emerging markets more broadly has

spilled over into commodity and currency markets," said David

Stubbs, a market strategist at J.P. Morgan Asset Management. The

fears about the impact of lower demand for raw materials from China

have pushed oil prices to six-year lows.

For banks with big emerging markets exposures, investors fret a

stuttering Asian economy will dial up the loan losses. Shares in

Standard Chartered and HSBC are down 40% and 24% over the last

year, respectively. A "real slowdown" in Asian markets would

"crystallize" loan losses at banks with big operations in the

region, said Nick Anderson, a banking analyst at Berenberg. "In

terms of provisioning, the pain is still to come."

Some analysts said the turmoil in Asia could add to pressure on

Standard Chartered to issue new capital. The bank, which makes

about a third of its operating profits in Greater China, is

considering raising additional equity. New Chief Executive Bill

Winters said during a recent conference for analysts that no

decision had been made yet on whether to do so.

"It seems logical that the group nonperforming loans will

continue to increase this year," said Joe Dickerson, an analyst at

Jefferies. But the bank could avoid issuing equity by cutting its

dividend and selling off assets, he added. In the first half of the

year, impairments jumped 15% to $1.7 billion on the back of

weakness in commodities markets. The bank has cut its commodities

exposure by 11% since the start of the year in an effort to stem

losses.

Both Standard Chartered and HSBC are also facing an imminent

Bank of England "stress test" that focuses in part on whether

lenders can ride out an emerging markets crash. The results of the

test, which is already under way and based on last year's

financials, will be presented on Dec 1.

Standard Chartered and HSBC declined to comment.

Executives at banks and insurers are putting on a brave face,

pointing to the fast growing nature of emerging market economies,

fueled by increased urbanization and a fast growing middle-class.

"Whilst we probably haven't seen fully the impact in terms of bad

debts and so on that come about from the sell off in the stock

market...We're still very much looking for 7%, 7.1% GDP growth for

this year for China," said HSBC Chief Executive Stuart Gulliver

during a call with analysts earlier this month. In June HSBC

executives unveiled a plan to divert extra resources into

bolstering its Asian franchise, which in the first half of the year

generated more than two thirds of its profit before tax.

Shares in London-based insurer Prudential PLC have also

suffered. The stock is down 12% since the start of July. Analysts

are predicting an inevitable slowdown in sales from its Hong Kong

and Chinese customers. Prudential has warned it faces difficulties

in its biggest Asian market, Indonesia, an economy sensitive to

falling commodity prices and a weakening currency. Six analysts

have downgraded 2015 growth forecasts for the company in the last

two months, according to FactSet.

A spokesman for the company said that its growth isn't

correlated with Asian equity markets and that there are still

increasing numbers of affluent people in China who need

insurance.

Write to Max Colchester at max.colchester@wsj.com and Juliet

Samuel at juliet.samuel@wsj.com

(END) Dow Jones Newswires

August 24, 2015 13:26 ET (17:26 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

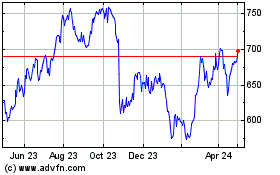

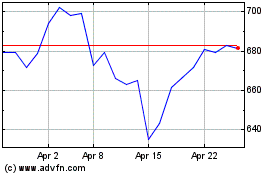

Standard Chartered (LSE:STAN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Standard Chartered (LSE:STAN)

Historical Stock Chart

From Apr 2023 to Apr 2024