U.K. Court Approves Rolls-Royce Corruption Settlement -- Update

January 17 2017 - 2:47PM

Dow Jones News

By Robert Wall

A U.K. court on Tuesday approved a deferred prosecution

agreement between Rolls-Royce Holdings PLC and Britain's Serious

Fraud Office to settle a four-year corruption investigation.

U.K. fraud investigators said Rolls-Royce engaged in illegal

business practices over a period spanning three decades and

activities in seven markets as the British blue-chip company

admitted guilt in the case. U.S. authorities found misconduct in

several additional jurisdictions.

Rolls-Royce on Monday said it struck similar agreements with

U.S. and Brazilian authorities and would pay more than $800 million

in fines. Shares in Rolls-Royce, which is no longer affiliated with

the luxury car maker, rose 4.44% in London as the controversy

hanging over the company for years neared an end.

The Serious Fraud Office said the agreement covers 12 counts of

conspiracy to corrupt, false accounting and failure to prevent

bribery. Wrongdoing took place in business dealings in Indonesia,

Thailand, India, Russia, Nigeria, China and Malaysia, the U.K.

government said.

Andrew Weissmann, chief of the Justice Department's fraud

section, said "for more than a decade, Rolls-Royce repeatedly

resorted to bribes to secure contracts and get a competitive edge

in countries throughout the world."

The U.S. government said bribery on Rolls-Royce contracts also

took place in Iraq, Angola, Azerbaijan and Kazakhstan in violation

of the U.S. Foreign Corrupt Practices Act. "The global nature of

this crime requires a global response," Mr. Weissmann said,

praising the cooperation with Brazilian and British

authorities.

The SFO found Rolls-Royce misconduct in the sale of commercial

aircraft engines for which the British company is best known.

Rolls-Royce is a major engine supplier to Airbus SE and Boeing Co.,

the two largest airliner makers. The SFO said misconduct involved

the sale of Rolls-Royce engines for Airbus A330 widebody aircraft

in China and Indonesia. The plane maker hasn't been implicated.

Corruption also was found involving sales of the company's

defense aerospace and former energy business.

As part of a DPA, governments agree to set side prosecution of

the company as long as it takes a number of remedial actions. If

the company doesn't honor the conditions, the prosecution may

resume. In this case the terms include paying financial penalties

and agreeing to cooperate with future prosecutions of

individuals.

The SFO said it was its "highest ever enforcement action"

against a British firm for criminal conduct.

Rolls-Royce said some employees involved in the actions had left

the company and that implicated intermediaries would no longer be

used. The company has cut back more broadly on use of middlemen

following an ethics review spurred by the SFO investigation.

The SFO said Rolls-Royce fired six employees and 11 left the

company amid a disciplinary review. Others were sanctioned.

The agreements with the three governments suspend prosecution of

the company as long as it meets certain criteria, including paying

the fine and supporting future prosecution of individuals.

Rolls-Royce Chairman Ian Davis said the company wanted to emerge

as a more trusted, resilient and better managed business that 'wins

right' every time."

Write to Robert Wall at robert.wall@wsj.com

(END) Dow Jones Newswires

January 17, 2017 14:32 ET (19:32 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

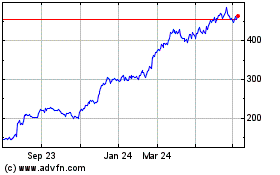

Rolls-royce (LSE:RR.)

Historical Stock Chart

From Mar 2024 to Apr 2024

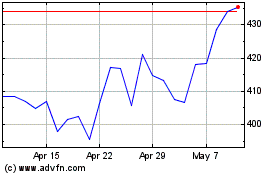

Rolls-royce (LSE:RR.)

Historical Stock Chart

From Apr 2023 to Apr 2024