U.K. Chancellor To Focus On Infrastructure Spending

November 22 2016 - 1:51AM

RTTF2

Britain's Chancellor of the Exchequer Philip Hammond is set to

prioritize infrastructure spending in his first Autumn Statement to

be published on November 23. The statement will also be the first

announcement on future budget plans from the government since the

U.K. voted to leave the EU in the referendum held late June.

Markets await to see whether Hammond unveils fiscal expansion to

make good the loss caused by the 'Brexit' decision.

The chancellor is expected to provide more funds to boost

broadband speed and raise infrastructure spending to attract more

businesses. He is also likely to lower corporate tax from the

current 17 percent.

The European Union as well as the U.K. currently face

uncertainty as 'Brexit' negotiations are set to begin next

year.

In an interview on the BBC's "Andrew Marr Show", Hammond said

forecasts of slowing economic growth poses a "sharp challenge" for

the public finances. He said the debt level was still

"eye-wateringly" large.

As Hammond has stressed that the economy is likely to face

difficult times ahead, IHS Global Insight economist Howard Archer

expects the government to provide some support now and to build-in

scope for increased fiscal support over the lifetime of this

parliament if need be.

It looks likely that he will at least build some flexibility

into the fiscal framework so he has scope to react if the economy

suffers a major relapse, Archer noted.

Hammond had earlier suggested that he will prioritize

infrastructure spending to support the economy.

The British Chambers of Commerce has urged the Chancellor to

support firms looking to recruit and invest in workforce, including

measures to boost investment and lower upfront business costs.

The Federation of Small Businesses called for more

infrastructure spending and reassurance from the chancellor that

there is no change in the government's commitment to permanently

increase small business rate relief and that no additional tax

burdens will be introduced.

The FSB said small firms currently rely on EU-funded local

infrastructure and business support. The lobby requested the

chancellor to provide clarity on schemes that address the needs of

UK small businesses when the nation finally exit the EU.

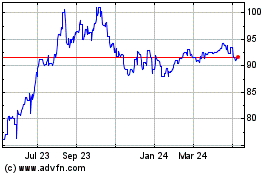

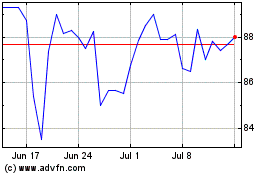

US Dollar vs RUB (FX:USDRUB)

Forex Chart

From Mar 2024 to Apr 2024

US Dollar vs RUB (FX:USDRUB)

Forex Chart

From Apr 2023 to Apr 2024