U.K. Banks Ordered to Provide Customers Better Deal

August 09 2016 - 6:00AM

Dow Jones News

LONDON—Banks in the U.K. could lose around £ 1 billion ($1.3

billion) in annual revenue under new measures designed to give

retail customers more choices and better deals.

Customers will also be encouraged to share personal data,

including records of their banking transactions, over digital

applications designed to scout out the best banking deals.

For years, Britain has been trying to foster greater competition

in retail banking and small business lending. However despite more

banks springing up, customers have stubbornly stuck with a handful

of lenders.

Unarranged overdraft charges, or fees for customers going into

debit on their accounts without permission, will be all but stamped

out under an order from the country's Competition and Markets

Authority. Banks currently make around £ 1.2 billion a year from

such charges, accounting for around one-third of their retail

revenue, the CMA said.

The new rules require banks to send alerts to customers when

their account dips below zero and to give them a grace period to

avoid charges. Banks will also have to set a monthly cap on

unarranged charges.

"We are breaking down the barriers which have made it too easy

for established banks to hold on to their customers," said Alasdair

Smith, chairman of the retail banking investigation.

The plan around overdraft charges had been announced when the

CMA made provisional findings on the sector's competition in May.

Analysts said banks would have to work harder to make fees from

retail customers but said it shouldn't have a big effect on the

sector's profits.

The measures are part of reforms announced Tuesday to shake up a

sector largely controlled by five lenders—Barclays PLC, HSBC

Holdings PLC, Royal Bank of Scotland Group PLC, Lloyds Banking

Group PLC and Santander UK. The banks house most of the country's

checking accounts and provide the bulk of mortgages and small

business loans.

The banks's major lobbying group, the BBA, said the sector is

already competitive and the plan for cross-sector digital apps will

further help customers find the best products.

Switching checking accounts is rare over a customer's lifetime,

largely because most of the U.K.'s banks offer "free in credit"

banking, meaning customers typically don't pay fees as long as they

have money in their accounts.

At the moment only 3% of personal customers and 4% of business

ones switch to a different bank in any year.

Some of the country's smaller banks said the CMA's

recommendations are too tame and won't make major inroads on the

current oligopoly.

"The CMA was given a rare opportunity to support and develop

competition in banking, it is disappointing that they decided not

to get at the root of the problem, but rather they missed the point

and tinkered around the edges," said Craig Donaldson, chief

executive officer at Metro Bank.

Ian Walker contributed to this article.

Write to Margot Patrick at margot.patrick@wsj.com

(END) Dow Jones Newswires

August 09, 2016 05:45 ET (09:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

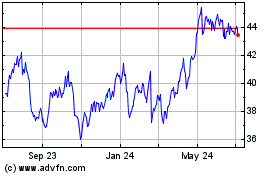

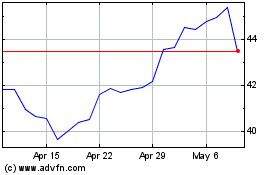

HSBC (NYSE:HSBC)

Historical Stock Chart

From Mar 2024 to Apr 2024

HSBC (NYSE:HSBC)

Historical Stock Chart

From Apr 2023 to Apr 2024