Tyco Tops Views, Says Johnson Controls Merger Will Close Ahead of Schedule

July 29 2016 - 9:00AM

Dow Jones News

Tyco International PLC on Friday reported better-than-expected

results in the most recent quarter and said its tie-up with Johnson

Controls Inc. is set to close earlier than previously

anticipated.

"We have continued to make great progress with integration

planning for our merger with Johnson Controls. We are now in

position to close the merger a month ahead of schedule," said Chief

Executive George Oliver. He also reaffirmed that Tyco remains

confident the deal will result in $1 billion in cost savings.

The companies agreed in January to merge in a $14 billion deal

that creates a new giant provider of commercial-building systems

and reflects a growing push by some executives and shareholders

toward companies that are bigger but more focused. The deal will

combine Johnson Controls' business selling heating and

air-conditioning equipment for skyscrapers, schools, hospitals and

other structures with Tyco's lines of security and fire-suppression

gear into a company with more than $30 billion a year in sales.

The new company will be renamed Johnson Controls PLC but will

maintain Tyco's Irish legal domicile—a so-called inversion deal

that brings shareholders tax benefits but has stirred

controversy.

Tyco, a fire-protection and security systems company, moved its

headquarters late last year to Cork, Ireland, from Switzerland, and

does more than half its business outside of the U.S. The stronger

U.S. dollar makes its products more expensive abroad.

In all for the June quarter, Tyco posted a profit of $239

million, or 56 cents a share, up from $156 million, or 37 cents a

share, a year earlier. On an adjusted basis, earnings from

continuing operations rose to 54 cents from 46 cents.

Revenue slipped 1.6% to $2.45 billion, as 1.5% organic growth

was more than offset by a 3% negative impact from the stronger U.S.

dollar against foreign currencies. Tyco said a three percentage

point benefit related to acquisitions was fully offset by a 3

percentage-point impact related to divestitures.

Analysts polled by Thomson Reuters were looking for adjusted

earnings of 53 cents a share on $2.44 billion in revenue.

Tyco shares, inactive premarket, have risen 18% over the past

three months.

Write to Anne Steele at Anne.Steele@wsj.com

(END) Dow Jones Newswires

July 29, 2016 08:45 ET (12:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

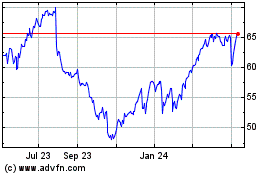

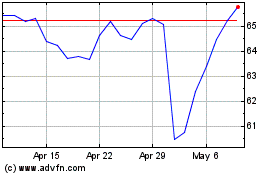

Johnson Controls (NYSE:JCI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Johnson Controls (NYSE:JCI)

Historical Stock Chart

From Apr 2023 to Apr 2024