Tyco International PLC (TYC) filed a Form 8K - Entry Into a

Definitive Agreement - with the U.S Securities and Exchange

Commission on January 27, 2016.

Merger Agreement

On January 24, 2016, Tyco International plc, an Irish public

limited company ("Tyco"), entered into an Agreement and Plan of

Merger (the "Merger Agreement") with Johnson Controls, Inc., a

Wisconsin corporation ("JCI"), and certain other parties named

therein, including Jagara Merger Sub LLC, a Wisconsin limited

liability company and indirect wholly owned subsidiary of Tyco

("Merger Sub"). Pursuant to the Merger Agreement and subject to the

terms and conditions set forth therein, Merger Sub will merge with

and into JCI (the "Merger"), with JCI surviving the Merger as an

indirect wholly owned subsidiary of Tyco. At the effective time of

the Merger, Tyco will change its name to "Johnson Controls plc" and

will trade under the ticker symbol "JCI." We refer to Tyco

following such time as the "Combined Company."

As a result of the Merger, each outstanding share of JCI common

stock (the "JCI Shares"), other than shares held by JCI, its

subsidiaries, Tyco or Merger Sub, will be converted into the right

to receive (subject to proration as described below), at the

holder's election, either: (i) one (1) (the "Exchange Ratio")

ordinary share of the Combined Company (the "Share Consideration");

or (ii) an amount in cash equal to $34.88 (the "Cash

Consideration"). Elections will be prorated so that JCI

shareholders will receive in the aggregate approximately $3.864

billion of cash in the Merger (the "Aggregate Cash Consideration").

Holders that do not make an election will be treated as having

elected to receive the Share Consideration. The Exchange Ratio

takes into account the effects of a Tyco share consolidation

contemplated by the Merger Agreement whereby, immediately prior to

the Merger, every issued and unissued ordinary share of Tyco (each,

a "Tyco Share") will be consolidated into 0.955 of a share of

Tyco.

Each outstanding award granted under JCI's equity-based

compensation plans denominated with respect to JCI Shares will be

converted into an award of the same type and equivalent value

denominated with respect to shares of the Combined Company. Such

converted awards generally will be subject to the same terms and

conditions as applied to the corresponding awards immediately prior

to consummation of the Merger. Each outstanding award granted under

Tyco's equity-based compensation plans denominated with respect to

a Tyco Share will be equitably adjusted in connection with the Tyco

share consolidation.

The completion of the Merger is subject to certain closing

conditions, including, among others, (i) the approval and adoption

of the Merger Agreement by holders of two-thirds of the JCI Shares

entitled to vote on such matter, (ii) the approval by the Tyco

shareholders, at a special meeting of the Tyco shareholders (the

"Tyco Special Meeting") of (A) the issuance of Tyco shares in

connection with the Merger, (B) the Tyco share consolidation and

(C) the increase in Tyco's authorized share capital, in each case,

by a majority of the votes cast on these matters at the Tyco

Special Meeting, and of certain amendments to Tyco's articles of

association, including a change of its name to "Johnson Controls

plc," by at least 75% of the votes cast on these matters at the

Tyco Special Meeting (clause (ii), collectively, the "Tyco

Shareholder Approvals"), (iii) the expiration or termination of any

waiting period applicable to the Merger under the Hart-Scott-Rodino

Antitrust Improvements Act of 1976, as amended, the consent of, or

filing with, certain specified antitrust authorities, and certain

other customary regulatory approvals, and (iv) Tyco's obtaining the

financing required to close the Merger on the terms set forth in

the Merger Agreement.

The Merger Agreement contains representations and warranties

that expire at the effective time of the Merger, as well as

covenants, including covenants providing for each of the parties

and their subsidiaries to conduct their business in all material

respects in the ordinary course during the period between the

execution of the Merger Agreement and the effective time of the

Merger and to use reasonable best efforts to cause the Merger to be

consummated. The Merger Agreement also includes covenants requiring

each of Tyco and JCI not to solicit, initiate or knowingly

encourage any inquiries, proposals or offers relating to

alternative business combination transactions or, subject to

certain exceptions, engage in any discussions or negotiations with

respect thereto or furnish any nonpublic information in furtherance

thereof. The Merger Agreement also requires each of Tyco and JCI to

call and hold a special meeting of shareholders, and, subject to

certain limited exceptions, requires Tyco's board of directors to

recommend the Tyco Shareholder Approvals and JCI's board of

directors to recommend the approval of the Merger Agreement at such

meetings. Either party's board of directors is also permitted to

change its recommendation in response to a "superior proposal" or

an "intervening event" (as defined with respect to Tyco or JCI, as

applicable, in the Merger Agreement).

The Merger Agreement contains specified termination rights,

including, among others, the right of either party to terminate the

Merger Agreement (i) if the requisite shareholder approvals have

not been obtained, (ii) if the board of directors of the other

party effects a change of recommendation, (iii) if the closing has

not occurred by October 24, 2016, subject to extension to January

24, 2017 in certain circumstances, (iv) in response to certain

intervening events (subject to the limitations set forth in the

Merger Agreement) or (v) if there is a material breach by the other

party of any of its representations, warranties or covenants,

subject to certain conditions.

The Merger Agreement provides, among other things, that a fee is

payable if the Merger Agreement is terminated in the following

circumstances: (i) if a party willfully breaches its

non-solicitation obligations or its obligation to call a special

meeting of its shareholders and the other party's board of

directors confirms that it does not intend to change its

recommendation, the party that willfully breached such obligations

must pay, following a termination by the other party of the Merger

Agreement, a termination fee of $375 million; (ii) if a party's

board of directors effects a change of recommendation in response

to a "superior proposal" or an "intervening event" that is not a

change or proposed change in law, and the other party's board of

directors confirms that it does not intend to change its

recommendation, the party whose board of directors changed its

recommendation must pay, following a termination by the other party

of the Merger Agreement, a termination fee of $375 million; (iii)

if one party's board of directors effects a change of

recommendation in response to an "intervening event" that is a

change or proposed change in law and the other party's board of

directors confirms that it does not intend to change its

recommendation, the party whose board of directors changed its

recommendation must pay, following a termination by the other party

of the Merger Agreement, a termination fee of $500 million; (iv) if

a party terminates the agreement in response to an "intervening

event" that is a change or proposed change in law and the other

party's board of directors confirms that its board has determined

that the transaction continues to be in the interests of the other

party's shareholders, the party that terminates the Merger

Agreement must pay a termination fee of $500 million; (v) if a

party receives a competing proposal, that party's shareholders

subsequently vote down the transaction, and that party consummates

or enters into a definitive agreement providing for a competing

proposal within 12 months, such party must pay a termination fee of

$375 million; and (vi) if a party's shareholders vote down the

transaction and the other party's shareholders approve the

transaction (and neither party's board of directors changes its

recommendation), the party whose shareholders voted down the

transaction must reimburse the other party's expenses up to a cap

equal to $35 million plus, in the case of payment to Tyco, up to

$65 million of financing costs.

At the effective time of the Merger, the board of directors of

the Combined Company will consist of eleven directors, six of whom

will be directors of the JCI board of directors prior to the

closing and five of whom will be directors of the Tyco board of

directors prior to the closing. The eleven directors of the

Combined Company will include the current Chief Executive Officer

of JCI, the current Chief Executive Officer of Tyco, and nine other

directors to be mutually agreed between JCI and Tyco.

...This item was truncated.

The full text of this SEC filing can be retrieved at:

http://www.sec.gov/Archives/edgar/data/833444/000119312516439970/d86179d8k.htm

Any exhibits and associated documents for this SEC filing can be

retrieved at:

http://www.sec.gov/Archives/edgar/data/833444/000119312516439970/0001193125-16-439970-index.htm

Public companies must file a Form 8-K, or current report, with

the SEC generally within four days of any event that could

materially affect a company's financial position or the value of

its shares.

(END) Dow Jones Newswires

January 27, 2016 17:21 ET (22:21 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

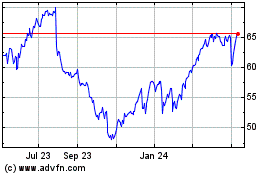

Johnson Controls (NYSE:JCI)

Historical Stock Chart

From Mar 2024 to Apr 2024

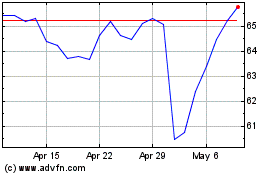

Johnson Controls (NYSE:JCI)

Historical Stock Chart

From Apr 2023 to Apr 2024