Tyco International PLC (TYC) filed a Form 8K - Changes in

Company Executive Management - with the U.S Securities and Exchange

Commission on January 27, 2016.

Employment Agreement with George Oliver

In connection with the Merger Agreement, Tyco entered into an

employment agreement, dated as of January 24, 2016, with Mr.

Oliver, which will become effective subject to, and contingent

upon, the completion of the Merger (the "Oliver Employment

Agreement"). The terms of the Oliver Employment Agreement generally

are comparable to the Amended and Restated Change of Control

Executive Employment Agreement entered into with JCI's current

Chairman, President, and Chief Executive Officer in connection with

the Merger Agreement, other than the definitions of "cause" and

"good reason," which are as set forth in the Oliver Employment

Agreement.

The Oliver Employment Agreement covers an initial employment

period of 33 months following the completion of the merger (the

"Transition Period"), and a two-year employment period following

any subsequent change of control.

Mr. Oliver will serve as the President and Chief Operating

Officer of the Combined Company until the First Succession Date.

Following the First Succession Date, Mr. Oliver will serve as chief

executive officer of the Combined Company, and beginning on the

Second Succession Date, Mr. Oliver will be appointed chairman of

the board of directors of the Combined Company. During the

Transition Period, Mr. Oliver will be entitled to a base salary of

$1,250,000 per year, and have a target annual bonus opportunity of

135% of his then-current base salary.

Under the Oliver Employment Agreement, if Mr. Oliver is

terminated by the Combined Company without cause, Mr. Oliver

resigns for good reason, or Mr. Oliver's employment ceases due to

his death or disability, he (or his beneficiary) will be entitled

to: (1) a lump sum severance payment equal to three times the sum

of Mr. Oliver's annual base salary and a bonus amount calculated

using the greater of his target bonus for the year of termination

or his annual bonus for the most recently completed fiscal year,

(2) payment of a prorated portion of the bonus amount for the year

of termination; (3) a cash payment equal to the lump sum value of

the additional benefits Mr. Oliver would have accrued through the

second anniversary of the merger under certain pension plans,

assuming Mr. Oliver is fully vested in such benefits at the time of

termination; and (4) continued medical and welfare benefits for a

two-year period following Mr. Oliver's date of termination (in the

case of a termination without "cause" or with "good reason").

Additionally, if the Combined Company terminates Mr. Oliver

other than for cause or Mr. Oliver terminates his employment for

good reason during the Transition Period, all equity awards granted

prior to the merger will vest, and all stock options granted to him

prior to the completion of the merger will remain exercisable until

the earlier of three years following Mr. Oliver's date of

termination and the date of expiration of the applicable stock

option award.

Following the Transition Period, and at any time other than the

two-year period following a subsequent change of control, upon the

termination of his employment, Mr. Oliver would be entitled to cash

severance not lower than the cash severance amount he would have

received upon a termination of his employment with Tyco prior to

entering into the Oliver Employment Agreement.

The foregoing description of the Oliver Employment Agreement

does not purport to be complete and is qualified in its entirety by

reference to the Oliver Employment Agreement, a copy of which is

attached hereto as Exhibit 10.3 and the terms of which are

incorporated herein by reference.

* * *

NO OFFER OR SOLICITATION

This communication is not intended to and does not constitute an

offer to sell or the solicitation of an offer to subscribe for or

buy or an invitation to purchase or subscribe for any securities or

the solicitation of any vote or approval in any jurisdiction, nor

shall there be any sale, issuance or transfer of securities in any

jurisdiction in contravention of applicable law.

ADDITIONAL INFORMATION AND WHERE TO FIND IT

In connection with the proposed transaction between Johnson

Controls, Inc. ("Johnson Controls") and Tyco International plc

("Tyco"), Tyco will file with the U.S. Securities and Exchange

Commission (the "SEC") a

registration statement on Form S-4 that will include a joint

proxy statement of Johnson Controls and Tyco that also constitutes

a prospectus of Tyco (the "Joint Proxy Statement/Prospectus").

Johnson Controls and Tyco plan to mail to their respective

shareholders the definitive Joint Proxy Statement/Prospectus in

connection with the transaction. INVESTORS AND SECURITY HOLDERS OF

JOHNSON CONTROLS AND TYCO ARE URGED TO READ THE JOINT PROXY

STATEMENT/PROSPECTUS AND OTHER RELEVANT DOCUMENTS FILED OR TO BE

FILED WITH THE SEC CAREFULLY WHEN THEY BECOME AVAILABLE BECAUSE

THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT JOHNSON CONTROLS,

TYCO, THE TRANSACTION AND RELATED MATTERS. Investors and security

holders will be able to obtain free copies of the Joint Proxy

Statement/Prospectus (when available) and other documents filed

with the SEC by Johnson Controls and Tyco through the website

maintained by the SEC at www.sec.gov. In addition, investors and

security holders will be able to obtain free copies of the

documents filed with the SEC by Johnson Controls by contacting

Johnson Controls Shareholder Services at

Shareholder.Services@jci.com or by calling (800) 524-6220 and will

be able to obtain free copies of the documents filed with the SEC

by Tyco by contacting Tyco Investor Relations at

Investorrelations@Tyco.com or by calling (609) 720-4333.

PARTICIPANTS IN THE SOLICITATION

Johnson Controls, Tyco and certain of their respective

directors, executive officers and employees may be considered

participants in the solicitation of proxies in connection with the

proposed transaction. Information regarding the persons who may,

under the rules of the SEC, be deemed participants in the

solicitation of the respective shareholders of Johnson Controls and

Tyco in connection with the proposed transactions, including a

description of their direct or indirect interests, by security

holdings or otherwise, will be set forth in the Joint Proxy

Statement/Prospectus when it is filed with the SEC. Information

regarding Johnson Controls' directors and executive officers is

contained in Johnson Controls' proxy statement for its 2016 annual

meeting of shareholders, which was filed with the SEC on December

14, 2015. Information regarding Tyco's directors and executive

officers is contained in Tyco's proxy statement for its 2016 annual

meeting of shareholders, which was filed with the SEC on January

15, 2016.

Statement Required by the Irish Takeover Rules

The directors of Tyco accept responsibility for the information

contained in this communication. To the best of their knowledge and

belief (having taken all reasonable care to ensure such is the

case), the information contained in this communication is in

accordance with the facts and does not omit anything likely to

affect the import of such information.

Lazard Freres & Co. LLC, which is a registered broker dealer

with the SEC, is acting for Tyco and no one else in connection with

the proposed transaction and will not be responsible to anyone

other than Tyco for providing the protections afforded to clients

of Lazard Freres & Co. LLC, or for giving advice in connection

with the proposed transaction or any matter referred to herein.

Centerview Partners LLC is a broker dealer registered with the

United States Securities and Exchange Commission and is acting as

financial advisor to JCI and no one else in connection with the

proposed transaction. In connection with the proposed transaction,

Centerview Partners LLC, its affiliates and related entities and

its and their respective partners, directors, officers, employees

and agents will not regard any other person as their client, nor

will they be responsible to anyone other than JCI for providing the

protections afforded to their clients or for giving advice in

connection with the proposed transaction or any other matter

referred to in this announcement.

Barclays Capital Inc. is a broker dealer registered with the

United States Securities and Exchange Commission and is acting as

financial advisor to JCI and no one else in connection with the

proposed transaction. In connection with the proposed transaction,

Barclays Capital Inc., its affiliates and related entities and its

and their respective partners, directors, officers, employees and

agents will not regard any other person as their client, nor will

they be responsible to anyone other than JCI for providing the

protections afforded to their clients or for giving advice in

connection with the proposed transaction or any other matter

referred to in this announcement.

...This item was truncated.

The full text of this SEC filing can be retrieved at:

http://www.sec.gov/Archives/edgar/data/833444/000119312516439970/d86179d8k.htm

Any exhibits and associated documents for this SEC filing can be

retrieved at:

http://www.sec.gov/Archives/edgar/data/833444/000119312516439970/0001193125-16-439970-index.htm

Public companies must file a Form 8-K, or current report, with

the SEC generally within four days of any event that could

materially affect a company's financial position or the value of

its shares.

(END) Dow Jones Newswires

January 27, 2016 17:21 ET (22:21 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

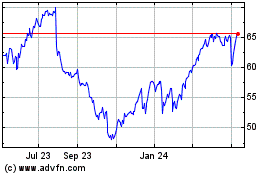

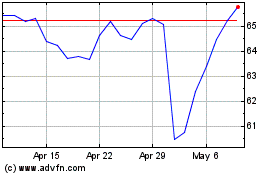

Johnson Controls (NYSE:JCI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Johnson Controls (NYSE:JCI)

Historical Stock Chart

From Apr 2023 to Apr 2024