Twitter to Cut Workforce as Revenue Growth Slows

October 27 2016 - 8:10AM

Dow Jones News

Twitter Inc. posted another quarter of slowing revenue growth

Thursday and said it would slash 9% of its global workforce, in its

first report since recent takeover interest from potential suitors

including Salesforce.com Inc. dissipated.

The social-media company's revenue rose 8.2% to $615.9 million,

its smallest gain and ninth straight period of declining growth.

Analysts expected revenue of $606 million.

Twitter recorded a loss of $102.9 million, or 15 cents per

share. Excluding certain expenses such as stock-based compensation

costs, Twitter posted a profit of 13 cents a share, compared with

the average analyst estimate of 9 cents per share.

Twitter's monthly active users totaled 317 million in the third

quarter, up just 1.7% from the second quarter. Cowen & Co.

analysts had projected Twitter's user base would rise to 315

million.

The company said its restructuring and workforce cuts focus

primarily on reorganizing its sales, partnerships and marketing

efforts as it seeks to become profitable in 2017. Twitter said it

expects to incur cash costs of $10 million to $20 million, as well

as stock-based compensation expense of $5 million to $10 million

associated with the restructuring, with most of the related charges

coming in the fourth quarter.

Shares, which have fallen 45% in the past 12 months, rose 4.3%

to $18.07 in premarket trading.

Twitter's results follow weeks of frenzied reports that the

company was fielding acquisition offers from Salesforce.com, Walt

Disney Co. and Google parent Alphabet Inc.—only to have them all

walk away earlier this month. Analysts don't expect another round

of takeover interest soon.

The lack of interest, at least for now, puts added pressure on

Chief Executive and co-founder Jack Dorsey, who has struggled to

accelerate revenue growth since retaking the CEO position a year

ago. Mr. Dorsey must reassure investors that the struggling company

is making headway on its strategy to reignite user growth, stem

slowing advertising revenue and rein in costs.

Skepticism among some analysts has deepened. Before Thursday's

results, Morgan Stanley analyst Brian Nowak wrote that marketers

are planning to decrease ad spend on Twitter compared with a year

earlier in favor of other services with "greater reach, lower

effective pricing and superior targeting."

Indeed, as Twitter's woes continue, bigger rivals like Facebook

have pulled further ahead while smaller upstarts like Snapchat,

Instagram and Pinterest are quickly gaining ground. There could be

"another wave of defections" at Twitter because of its lack of

traction on recent product initiatives, SunTrust Banks Inc. analyst

Bob Peck wrote in a recent research note.

Besides incremental product tweaks, Mr. Dorsey is banking on the

social media company's push to live-stream premium content such as

National Football League games and the recent presidential debates.

Twitter struck a $10 million deal with the NFL to live stream

Thursday night games.

Twitter attracted an average audience of more than 200,000

viewers for its first seven games through last week under the

partnership. But only two of the 10 Thursday night NFL games it

acquired the rights to stream took place in the third quarter.

An average of 243,000 viewers a minute tuned into the first

game, featuring the New York Jets against the Buffalo Bills on

Sept. 15. The second game between the Houston Texans and New

England drew a bigger average audience—roughly 327,000.

More than bringing in new ad-revenue opportunities, Twitter

executives hope its live-streaming content will help broaden its

user base to mainstream users—namely, those who haven't understood

the purpose of Twitter—and increase engagement on the platform as

people tweet about the games and shows being broadcast.

In a recent report, Wells Fargo analyst Peter Stabler noted that

an analysis of Nielsen Social TV ratings data showed that Twitter

enjoyed a substantial bump in the share of social engagement around

its inaugural NFL live-stream on Sept. 15. But that lift has

steadily fallen during subsequent games.

Morgan Stanley analysts project the NFL deal will generate just

$11 million in incremental ad revenue in the fourth quarter.

Excluding that benefit, Twitter's owned-and-operated ad revenue

will grow just 1%, according to Morgan Stanley.

Write to Deepa Seetharaman at Deepa.Seetharaman@wsj.com

(END) Dow Jones Newswires

October 27, 2016 07:55 ET (11:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

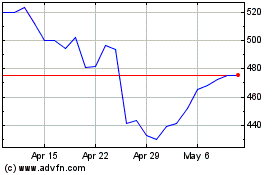

Meta Platforms (NASDAQ:META)

Historical Stock Chart

From Mar 2024 to Apr 2024

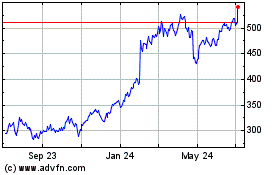

Meta Platforms (NASDAQ:META)

Historical Stock Chart

From Apr 2023 to Apr 2024