Tullow Oil Proposes $750 Million Rights Issue

March 17 2017 - 3:55AM

Dow Jones News

LONDON--Tullow Oil PLC (TLW.LN) Friday proposed a rights issue

of 466.9 million new shares at 130 pence (158.6 cents) each to

raise $750 million.

"Tullow has taken a number of significant steps since 2014 to

re-set and restructure the business to ensure the Group is well

positioned to meet the challenge of lower oil prices. As a result,

we are now producing positive free cash flow and have begun the

process of reducing our debt," Chief Operating Officer and Chief

Executive Officer-designate Paul McDade said.

"Tullow has a strong set of low cost production, development and

exploration assets in Africa and South America and, by accelerating

the reduction of our gearing through this Rights Issue, we will be

able to focus on growing our business by investing more across our

portfolio and taking advantage of opportunities that industry

conditions present," Mr. McDade said.

The oil and gas explorer said the issue price is a 45% discount

to the closing price of 237.3 pence on Thursday.

Also Friday Tullow said CNOOC Uganda Ltd. (CNOOC) has notified

Tullow that it has exercised its pre-emption rights under the joint

operating agreements between Tullow, Total and CNOOC to acquire 50%

of the interests being transferred to Total on the same terms and

conditions that were agreed between Tullow and Total.

-Write to Razak Musah Baba at razak.baba@wsj.com; Twitter:

@Raztweet

(END) Dow Jones Newswires

March 17, 2017 03:40 ET (07:40 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

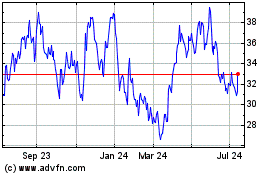

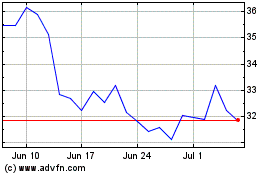

Tullow Oil (LSE:TLW)

Historical Stock Chart

From Mar 2024 to Apr 2024

Tullow Oil (LSE:TLW)

Historical Stock Chart

From Apr 2023 to Apr 2024