TIDMTLW

RNS Number : 7537R

Tullow Oil PLC

01 July 2015

Tullow Oil plc - Trading Statement & Operational Update

Actions taken in the first half to re-set the business, improve

funding liquidity and cut costs

Strong West Africa oil production in the first half; 2015 full

year guidance increased

TEN Project remains within budget and on schedule for first oil

in mid-2016

1 July 2015 - Tullow Oil plc (Tullow) issues this statement to

summarise recent operational activities and to provide trading

guidance in respect of the financial year to 30 June 2015. This is

in advance of the Group's Half Year Results, which are scheduled

for release on Wednesday 29 July 2015. The information contained

herein has not been audited and may be subject to further

review.

COMMENTING TODAY, AIDAN HEAVEY, CHIEF EXECUTIVE SAID:

"We have taken a number of important steps to ensure that Tullow

remains on a firm financial footing. This approach is paying off

with good progress across the business in the first half of 2015.

Our major oil producing assets in West Africa have performed

strongly and we have upgraded our 2015 full year production

forecast accordingly. The TEN Project remains within budget and on

track for first oil in mid-2016. In East Africa, we are making

steady progress towards project sanction with good appraisal and

test results from our wells in Northern Kenya and strong support

from the Governments of Kenya and Uganda. Finally, we continue to

build our inventory of exploration prospects to provide options

when market conditions improve."

Operational Update

PRODUCTION

In the first half of 2015, West Africa working interest oil

production was within guidance averaging 66,500 bopd. As a result

of strong performance from Jubilee and the non-operated portfolio,

2015 working interest production guidance for West Africa has been

increased to 66,000-70,000 bopd from 63,000-68,000 bopd. In Europe,

working interest gas production for the first half of 2015 was

within guidance averaging 8,100 boepd. This figure includes the

impact of the completion of a Netherlands gas asset sale on 30

April 2015 to AU Energy. Average working interest production

guidance in Europe, having been adjusted by 1,000 boepd to account

for this sale, is now 6,000-8,000 boepd from 6,000-9,000 boped.

WEST AFRICA

Jubilee production performance has remained strong averaging

around 105,000 bopd gross (37,300 bopd net) during the first half

of 2015. Final commissioning of the onshore gas processing facility

was completed in March 2015 and since then gas exports from the

Jubilee field have averaged around 80 mmscfd. Tullow plans to drill

two additional Phase 1A wells and the first of these, J-37, has

commenced drilling. In light of the performance of the Jubilee

field year to date and the decision to have a planned one week

shutdown in the second half of 2015, Tullow has increased its full

year 2015 average working interest production guidance for the

field to 103,000 bopd (36,500 bopd net). Work continues to

incorporate the Mahogany, Teak and Akasa resources in the Greater

Jubilee Full Field Development Plan which the partnership plans to

submit to the Government of Ghana by year-end.

The TEN Project continues to make excellent progress and remains

within budget and on schedule for first oil in mid-2016. Important

milestones on the project achieved during the second quarter

included: the running of the first two of ten well completions; the

installation of the turret on the bow of the FPSO; the first

in-country fabrication works made ready for the start of the

offshore installation campaign in mid-July; and specialist subsea

manifolds and umbilicals from the USA made ready for transport to

Ghana. Following the 25 April ruling from the Special Chamber of

the International Tribunal of the Law of the Sea (ITLOS) on

Provisional Measures, discussions are ongoing with the Government

of Ghana on their implementation and no impact is expected on

project activity to first oil.

In Gabon, due to ongoing licence discussions with the Government

regarding the Onal fields, Tullow has not included Onal

(approximately 2,000 bopd net), in its first half 2015 Group

production figures. However, an agreement with the Government is

expected and Tullow has retained the annual production from the

fields in its Group 2015 full year guidance.

EAST AFRICA

In East Africa, progress is being made on the decision regarding

the route of the export pipeline with the Technical Consultant

having submitted its final feasibility report to the Governments of

Uganda and Kenya. It is expected that the Governments will shortly

agree on the preferred routing which will enable the next phase of

work on the pipeline to progress.

Kenya operations have been focused on the South Lokichar Blocks

10BB and 13T where appraisal drilling and Extended Well Tests (EWT)

are continuing. In May, the Amosing EWT commenced and five

reservoir zones in the field were tested across two wells, being

separately produced in one well while pressure responses were

measured in the other well. Production from all five zones was at a

combined average constrained rate of 4,300 bopd under natural flow

conditions and a cumulative volume of 30,000 barrels of oil was

produced into storage. The pressure data supports significant

connected oil volumes and confirms lateral reservoir continuity

between the wells which is positive for the future development of

the Amosing field. Having completed the production testing,

preparations are now under way for water injection tests into each

of the five completed reservoir zones in Amosing-2A. These tests

will validate the viability of water flood reservoir management and

the oil recovery assumptions for the Field Development Plan.

Elsewhere in the South Lokichar basin, preparations for the

Ngamia field EWT are under way. Multi zone completions were

installed in the Ngamia-8, Ngamia-3 and Ngamia-6 wells. Initial

rig-less flow testing during clean-up was at a combined maximum

rate of 3,900 bopd and 1,740 bopd of 30 to 33 degree API oil for

Ngamia-8 and Ngamia-3 with Ngamia-6 clean-up flow testing ongoing.

These initial results are very encouraging.

The PR Marriott 46 rig spudded the Ngamia-9 appraisal well on 13

June 2015. Following this well, the rig will then move to drill the

Twiga-3 and Amosing-5 appraisal wells, completing the 2015

appraisal drilling activities. In the third quarter of 2015, a

basin testing exploration well is planned at Cheptuket in Block

12A. The well will test a basin bounding structural closure in a

similar structural setting to the successful discoveries along the

western bounding rift basin fault in the South Lokichar basin.

In Uganda, progress has been made on several fiscal matters

which it is hoped will enable substantive progress to be made

towards the sanction of the Lake Albert oil development. On 11 June

2015, the Government announced that it had amended the VAT Act to

relieve oil exploration and development from VAT. On 22 June 2015,

following constructive discussions with the Government of Uganda

and the URA, Tullow announced that it had agreed to pay $250

million in full and final settlement of its CGT liability for the

farm-downs to Total and CNOOC that completed in 2012. This sum

comprises $142 million that Tullow paid in 2012 and $108 million to

be paid in three equal installments. The first of these was paid

upon settlement and the remainder will be paid in 2016 and

2017.

EUROPE AND SOUTH AMERICA

In Norway, Tullow completed the Bjaaland exploration well in May

with only residual oil shows encountered. The well was plugged and

abandoned. The Leiv Eiriksson semi-submersible drilled the Bjaaland

well and moved to the Tullow operated Zumba prospect which

completed drilling in June and was plugged and abandoned as a dry

hole.

Tullow has also been actively managing its equity position and

exposure to drilling costs in Norway across a number of licences.

Completed farmdown transactions resulted in a reduction to Tullow's

equity in the Zumba and Hagar prospects to 40% and 10%

respectively, subject to Government approval.

In the Netherlands, Tullow completed the sale of its operated

and non-operated interests in the L12/15 area and Blocks Q4 and Q5

to AU Energy on 30 April 2015. The consideration was EUR64 million

for the sale of approximately 1,500 boepd. On 5 June 2015, a

farmdown to GDF Suez E&P Nederland completed resulting in the

sale of 30% equity and the operatorship of Exploration Licences

E10, E11 (including Tullow's Vincent discovery), E14, E15c and

E18b. Following these and previous deals, Tullow no longer holds

any operated licences in the UK or Netherlands.

In the Caribbean-Guyanas, Tullow has been very active maturing

its exploration opportunities in the region. In May, the Spari-1

well in Suriname commenced drilling with a result expected in

August. In Jamaica, where Tullow has a significant offshore acreage

position, a bathymetry survey has been completed on the Walton

& Mourant Blocks. The survey results provided indications of

possible seeps on which to position drop cores and this operation

has commenced.

Trading Statement Guidance

Guidance is provided in relation to Tullow's half year reporting

to 30 June 2015 in advance of the Group's Half Year Results release

on 29 July 2015. Guidance figures are subject to change.

SALES, REVENUE AND GROSS PROFIT

1H 2015 1H 2014

=================================================== ========= ============

West Africa working interest

production (bopd) 66,500 63,900

--------------------------------------------------- --------- ------------

Europe working interest

production (boepd) 8,100 14,500

--------------------------------------------------- --------- ------------

Sales volumes (boepd) 66,500 73,200

--------------------------------------------------- --------- ------------

Total revenue ($ bn) 0.8 1.3

--------------------------------------------------- --------- ------------

Gross profit ($ bn) 0.3 0.7

--------------------------------------------------- --------- ------------

Administrative expenses

($ bn) 0.1 0.1

--------------------------------------------------- --------- ------------

Pre-tax operating cash flow

(before working capital)

($ bn) 0.5 0.9

=================================================== ========= ============

Note 1: Working interest production volumes do not

equate to sales volumes. This is due to variations

in lifting schedules and because a portion of the

production is delivered to host governments under

the terms of Production Sharing Contracts.

Note 2: The decline of Europe working interest production

and sales volumes can be attributed to the farm-downs

of the Q&L Blocks (Netherlands) in 1H 2015 and of

Schooner and Ketch (UK) in 2014.

Note 3: Administrative expenses (G&A) are essentially

flat in 1H 2015 as the impact of organisation simplification

changes will not start to be realised until 2H 2015.

Tullow is on track to achieve its $500 million savings

target over 3 years.

REALISED PRICES

1H 2015 1H 2014

=================================================== ========= ============

1H 2015 Realised post

hedge oil price ($/bl) 71.4 106.7

--------------------------------------------------- --------- ------------

1H 2015 Realised post

hedge gas price (p/therm) 46.2 55.2

=================================================== ========= ============

HEDGING INSTRUMENTS

1H 2015 1H 2014

============================== ========

(Loss)/gain on hedging

instruments ($m) (50) (18)

======================== ===== ========

Note 4: The $50m loss is an estimate at 31 May 2015; the actual

period end figure to be reported in the Half year results may

differ. The $50m loss is in relation to the changes in time value

of the Group's commodity derivative instruments over the last 6

months, driven by changes in implied volatility and the movement in

the forward curve during the period. As at 29 May 2015, the Group's

derivative instrument had a positive fair value of $270 million,

inclusive of deferred premium.

HEDGING POSITION (as at 29 June 2015) 2H 2015 2016 2017 2018

========================================= ======== ======= ======= ======

Oil Volume (bopd) 34,500 31,257 19,500 5,000

========================================= ======== ======= ======= ======

Average Floor price protected ($/bbl) 85.98 79.29 76.68 68.04

========================================= ======== ======= ======= ======

Gas Volume (mmscfd) 3.73 0.62

========================================= ======== ======= ======= ======

Average Floor price protected (p/therm) 55.00 63.00

========================================= ======== ======= ======= ======

EXPLORATION WRITE OFF

Pre-tax write off Tax effect Net write off

=========================== ================== =========== ==============

1H 2015 activity ($m) 75 (37) 38

--------------------------- ------------------ ----------- --------------

Prior years activity ($m) 10 (8) 2

--------------------------- ------------------ ----------- --------------

1H 2015 Total ($m) 85 (45) 40

=========================== ================== =========== ==============

Note 5: During 1H 2015 the Group spent $0.15 billion, including

Norway exploration costs on a post tax cash basis, on exploration

and appraisal activities, and expects to write off approximately

$38 million in relation to this expenditure. The Group expects to

write-off approximately $2 million of prior year expenditure in

Norway. Therefore, the total net exploration write-offs for 1H 2015

are expected to be approximately $40 million. This will be shown in

the income statement as a $85 million exploration write-off and an

income tax credit of $45 million in relation to tax relief received

in respect of Norwegian expenditure.

LOSS ON DISPOSAL & RESTRUCTURING

COSTS

1H 2015 1H 2014

==================================== ======== ========

Loss on disposal ($m) 50 115

------------------------------------ -------- --------

Restructuring costs (gross) 47 -

($m)

------------------------------------ -------- --------

Restructuring costs (net) 17 -

($m)

==================================== ======== ========

Note 6: The loss on disposal relates to the farm-down of the

Q&L blocks in the Netherlands, where $55m net of adjustments

was received in cash.

Note 7: Gross restructuring costs are the total costs Tullow is

expecting to occur in respect of the simplification project

announced in November 2014. Net restructuring costs represent the

portion of these costs that relate to corporate G&A activities

that have not been recharged to capital projects, operating costs

or partners.

TAXATION

1H 2015 1H 2014

===================================== =================== ======================

Tax Charge ($m) 60 66

===================================== =================== ======================

Note 8: After adjusting for exploration write-offs,

impairments, related deferred tax benefits, and

profits/losses on disposal, the Group's underlying

effective tax rate is between 30-35%. With the inclusion

of these items the Group's net tax charge in the

income statement is a charge of $60m, which includes

a $108m prior year charge for Ugandan CGT.

CAPITAL EXPENDITURE

2015 full

1H 2015 year

===================================== =================== ======================

Capital expenditure

($ bn) 0.9 1.9

------------------------------------- ------------------- ----------------------

E&A/D&O split

(%) 15/85 10/90

===================================== =================== ======================

Note 9: Capital expenditure excludes acquisition

costs and includes Norway exploration costs on a

post tax cash basis.

DEBT SUMMARY

As at 30 Jun

As at 30 Jun 2015 2014

===================================== =================== ======================

Net Debt ($bn) 3.6 2.8

------------------------------------- ------------------- ----------------------

Facility Headroom

($bn) 2.1 2.3

------------------------------------- ------------------- ----------------------

Free Cash ($bn) 0.2 0.2

------------------------------------- ------------------- ----------------------

Committed Bank

Facilities ($bn) 5.0 4.75

------------------------------------- ------------------- ----------------------

Corporate Bonds

($bn) 1.3 1.3

===================================== =================== ======================

Note 10: On 19 March 2015 Tullow arranged a $0.2bn increase in

commitments on its Reserves Based Lending Facility and a $0.25bn

increase in commitments on its Revolving Corporate Facility.

Note 11: Committed bank facilities include an Exploration

Finance Facility of c.$300m, a working capital facility relating to

exploration expenditure on our Norwegian exploration licences.

GROUP AVERAGE WORKING INTEREST PRODUCTION (1)

1H 2015 2015 Full Year

Actual (kboepd) Forecast (kboepd)

======================= ===================================================== ===========================================

Ghana 37.3 36.5

======================= ===================================================== ===========================================

Equatorial Guinea

----------------------- ----------------------------------------------------- -------------------------------------------

Ceiba 3.0 2.8

----------------------- ----------------------------------------------------- -------------------------------------------

Okume 6.1 5.5

======================= ===================================================== ===========================================

Total

Equatorial

Guinea 9.1 8.3

======================= ===================================================== ===========================================

Gabon

----------------------- ----------------------------------------------------- -------------------------------------------

Tchatamba 5.2 4.8

----------------------- ----------------------------------------------------- -------------------------------------------

Limande 2.1 2.6

----------------------- ----------------------------------------------------- -------------------------------------------

Etame

Complex 1.4 1.6

----------------------- ----------------------------------------------------- -------------------------------------------

Other Gabon 4.1 6.1

======================= ===================================================== ===========================================

Total Gabon 12.8 15.1

======================= ===================================================== ===========================================

Côte d'Ivoire 3.9 4.3

======================= ===================================================== ===========================================

Congo (Brazzaville) 2.2 2.2

======================= ===================================================== ===========================================

Mauritania 1.2 1.1

======================= ===================================================== ===========================================

West Africa sub-total 66.5 68.0

======================= ===================================================== ===========================================

UK 3.9 3.4

======================= ===================================================== ===========================================

Netherlands 4.2 3.6

======================= ===================================================== ===========================================

Europe sub-total 8.1 7.0

======================= ===================================================== ===========================================

GROUP TOTAL 74.6 75.0

======================= ===================================================== ===========================================

(1) Includes condensate

CURRENTLY PLANNED 2015 EXPLORATION AND APPRAISAL ACTIVITY

Country Block/Licence Prospect/Well Interest Spud Date

======================== =============== ==================== ========== ===========

WEST AFRICA

========================================= ==================== ========== ===========

Gabon Nziembou Igongo-1 test 40% In progress

------------------------ --------------- -------------------- ---------- -----------

EAST AFRICA

========================================= ==================== ========== ===========

Kenya 12A Cheptuket 65% (op) Q3 2015

(ex-Lekep)

------------------------ --------------- -------------------- ---------- -----------

10BB Amosing-5 50% (op) Q3 2015

appraisal

---------------------- --------------- -------------------- ---------- -----------

10BB Ngamia-9 appraisal 50% (op) In progress

--------------- -------------------- ---------- -----------

13T Twiga-3 appraisal 50% (op) Q3 2015

---------------------- --------------- -------------------- ---------- -----------

EUROPE, SOUTH AMERICA

& ASIA

========================================= ==================== ========== ===========

Norway PL642 Hagar 10% Q3 2015

------------------------ --------------- -------------------- ---------- -----------

Netherlands J09 Alpha-North 9.95% Q3 2015

------------------------ --------------- -------------------- ---------- -----------

K15 FG-SE-B appraisal 9.95% In progress

---------------------- --------------- -------------------- ---------- -----------

K15 FI-N 9.95% In progress

---------------------- --------------- -------------------- ---------- -----------

Suriname Block 31 Spari 30% In progress

------------------------ --------------- -------------------- ---------- -----------

Pakistan Kalchas Kup 30% In progress

======================== =============== ==================== ========== ===========

FOR FURTHER INFORMATION CONTACT:

Tullow Oil plc Citigate Dewe Rogerson Murray Consultants

(London) (London) (Dublin)

(+44 20 3249 9000) (+44 207 638 9571) (+353 1 498 0300)

Chris Perry (Investor Martin Jackson Ed Micheau

Relations) Shabnam Bashir Pat Walsh

James Arnold (Investor

Relations)

George Cazenove

(Media Relations)

======================== ======================= ===================

Notes to Editors

Tullow Oil plc

Tullow is a leading independent oil & gas, exploration and

production group, quoted on the London, Irish and Ghanaian stock

exchanges (symbol: TLW). The Group has interests in over 130

exploration and production licences across 22 countries which are

managed as three Business Delivery Teams.

Follow Tullow on:

Twitter: www.twitter.com/TullowOilplc

You Tube: www.youtube.com/TullowOilplc

Facebook: www.facebook.com/TullowOilplc

LinkedIn: www.linkedin.com/company/Tullow-Oil

IR App: bit.ly/TullowApp

Website: www.tullowoil.com

This information is provided by RNS

The company news service from the London Stock Exchange

END

TSTPKKDNABKDKAN

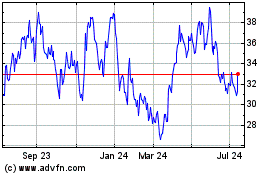

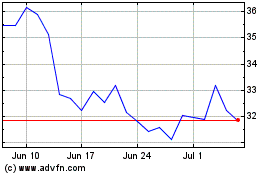

Tullow Oil (LSE:TLW)

Historical Stock Chart

From Mar 2024 to Apr 2024

Tullow Oil (LSE:TLW)

Historical Stock Chart

From Apr 2023 to Apr 2024