Tullett Prebon PLC Publication of Supplementary Prospectus (6000J)

September 12 2016 - 10:49AM

UK Regulatory

TIDMTLPR

RNS Number : 6000J

Tullett Prebon PLC

12 September 2016

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN WHOLE OR IN PART

IN, INTO OR FROM ANY JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A

VIOLATION OF THE RELEVANT LAWS OR REGULATIONS OF THAT

JURISDICTION

This announcement is an advertisement for the purposes of the

United Kingdom Prospectus Rules and not a prospectus and not an

offer of securities for sale in any jurisdiction. Neither this

announcement nor anything contained herein shall form the basis of,

or be relied upon in connection with, any offer or commitment

whatsoever in any jurisdiction. Investors should not purchase or

subscribe for any shares referred to in this announcement except on

the basis of information in the Prospectus (as defined below), the

First Supplementary Prospectus (as defined below), the Second

Supplementary Prospectus (as defined below) and the Third

Supplementary Prospectus (as defined below) published by Tullett

Prebon plc today. This announcement does not constitute an offer of

securities for sale, or an offer to acquire or exchange securities

in the United States or in any other jurisdiction.

FOR IMMEDIATE RELEASE

12 September 2016

Tullett Prebon plc

Publication of Third Supplementary Prospectus

Further to the publication of a combined class 1 circular and

prospectus (the "Prospectus") on 1 March 2016, a supplementary

prospectus (the "First Supplementary Prospectus") on 5 April 2016

and a second supplementary prospectus (the "Second Supplementary

Prospectus") on 16 May 2016 in connection with the proposed

acquisition by Tullett Prebon plc ("Tullett Prebon") of the global

hybrid voice broking and information business of ICAP plc ("ICAP")

including ICAP's associated technology and broking platforms

(including iSwap and Fusion) and certain of ICAP's joint ventures

and associates (the "Transaction"), Tullett Prebon announces that

it has published a third supplementary prospectus (the "Third

Supplementary Prospectus").

The publication of the Third Supplementary Prospectus is a

regulatory requirement under the Prospectus Rules following the

entry into an amended acquisition agreement reflecting the change

to the structure of the Transaction as set out in the announcement

released by Tullett Prebon on 21 June 2016.

The Third Supplementary Prospectus has been approved by the UK

Listing Authority and is available on Tullett Prebon's website,

http://www.tullettprebon.com and will be submitted to the National

Storage Mechanism, where it will be available for inspection at

www.morningstar.co.uk/uk/nsm.do.

Enquiries

Tullett Prebon

+44 (0)20 7200

Alexandra Wick (Marketing & Communications) 7579

Rothschild (Financial Adviser and

Sponsor to Tullett Prebon)

Stephen Fox +44 (0)20 7280

Toby Ross 5000

HSBC (Joint Corporate Broker to

Tullett Prebon)

Nick Donald +44 (0)20 7991

Peter Glover 8888

Numis (Joint Corporate Broker to

Tullett Prebon)

Michael Meade +44 (0)20 7260

Charles Farquhar 1000

Brunswick +44 (0)20 7404

Kim Fletcher 5959

Mike Smith tullettprebon@brunswickgroup.com

Craig Breheny

Important notice

N M Rothschild & Sons Limited ("Rothschild"), which is

authorised by the Prudential Regulatory Authority and regulated by

the Financial Conduct Authority and the Prudential Regulation

Authority in the United Kingdom, is acting as sponsor and financial

adviser to Tullett Prebon in connection with the Transaction.

Rothschild is acting exclusively for Tullett Prebon and no-one else

in connection with the Transaction and save for any

responsibilities and liabilities, if any, which may be imposed on

Rothschild, in its capacity as sponsor by the Financial Services

and Markets Act 2000, as amended, Rothschild will not be

responsible to anyone other than Tullett Prebon for providing the

protections afforded to clients of Rothschild or for providing

advice in relation to the Transaction or the contents of this

announcement or any transaction, arrangement or matter referred to

herein. The information provided in this announcement is entirely

based on information provided by Tullett Prebon and has not been

independently verified by Rothschild. Accordingly, Rothschild does

not accept any responsibility or liability whatsoever, and makes no

representations or warranty, express or implied, for the contents

of this announcement. Rothschild disclaims, to the fullest extent

permitted by law all and any responsibility and liability howsoever

arising which it might otherwise have in respect of this

announcement.

HSBC Bank plc ("HSBC"), which is authorised by the Prudential

Regulation Authority and regulated by the Financial Conduct

Authority and the Prudential Regulation Authority, is acting as

Joint Corporate Broker to Tullett Prebon in connection with the

Transaction. HSBC is acting exclusively for Tullett Prebon and

no-one else in connection with the Transaction. HSBC will not be

responsible to anyone other than Tullett Prebon for providing the

protections afforded to clients of HSBC or for providing advice in

relation to the Transaction or the contents of this announcement or

any transaction, arrangement or matter referred to herein. The

information provided in this announcement is entirely based on

information provided by Tullett Prebon and has not been

independently verified by HSBC. Accordingly, HSBC does not accept

any responsibility or liability whatsoever, and makes no

representations or warranty, express or implied, for the contents

of this announcement. HSBC disclaims, to the fullest extent

permitted by law all and any responsibility and liability howsoever

arising which it might otherwise have in respect of this

announcement.

Numis Securities Limited ("Numis"), which is authorised and

regulated by the Financial Conduct Authority, is acting as Joint

Corporate Broker to Tullett Prebon in connection with the

Transaction. Numis is acting exclusively for Tullett Prebon and

no-one else in connection with the Transaction. Numis will not be

responsible to anyone other than Tullett Prebon for providing the

protections afforded to clients of Numis or for providing advice in

relation to the Transaction or the contents of this announcement or

any transaction, arrangement or matter referred to herein. The

information provided in this announcement is entirely based on

information provided by Tullett Prebon and has not been

independently verified by Numis. Accordingly, Numis does not accept

any responsibility or liability whatsoever, and makes no

representation or warranty, express or implied, for the contents of

this announcement. Numis disclaims, to the fullest extent permitted

by law all and any responsibility and liability howsoever arising

which it might otherwise have in respect of this announcement.

This announcement has been issued by and is the sole

responsibility of Tullett Prebon.

This announcement is not intended to, and does not, constitute

or form part of any offer, invitation or the solicitation of an

offer to purchase, otherwise acquire, subscribe for, sell or

otherwise dispose of, any securities pursuant to this announcement

or otherwise. The distribution of this announcement in

jurisdictions outside the United Kingdom may be restricted by law

and therefore persons into whose possession this announcement comes

should inform themselves about, and observe such restrictions. Any

failure to comply with the restrictions may constitute a violation

of the securities law of any such jurisdiction.

This announcement does not constitute an offer of securities for

sale in the United States or an offer to acquire or exchange

securities in the United States. No offer to acquire securities or

to exchange securities for other securities has been made, or will

be made, and no offer of securities has been made, or will be made,

directly or indirectly, in or into, or by use of the mails, any

means or instrumentality of interstate or foreign commerce or any

facilities of a national securities exchange of, the United States

of America or any other country in which such offer may not be made

other than (i) in accordance with the requirements under the US

Securities Exchange Act of 1934, as amended, a registration

statement under the US Securities Act of 1933, as amended, or the

securities laws of such other country, as the case may be, or (ii)

pursuant to an available exemption therefrom. No securities are

intended to be registered under the US Securities Act of 1933, as

amended.

This announcement has been prepared for the purposes of

complying with the applicable law and regulation of the United

Kingdom (including the Listing Rules, the disclosure requirements

imposed by the Market Abuse Regulation (Regulation (EU) No

596/2014) and the Transparency Rules) and the information disclosed

may not be the same as that which would have been disclosed if this

announcement had been prepared in accordance with the laws and

regulations of any jurisdiction outside of the United Kingdom.

This information is provided by RNS

The company news service from the London Stock Exchange

END

PSPDMGMLDZZGVZM

(END) Dow Jones Newswires

September 12, 2016 10:49 ET (14:49 GMT)

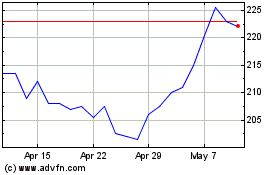

Tp Icap (LSE:TCAP)

Historical Stock Chart

From Mar 2024 to Apr 2024

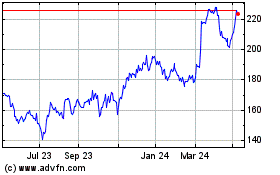

Tp Icap (LSE:TCAP)

Historical Stock Chart

From Apr 2023 to Apr 2024